You probably heard of the stock market growing up as a child, yet I bet you never really took the time to really answer this question: Why invest in stocks?

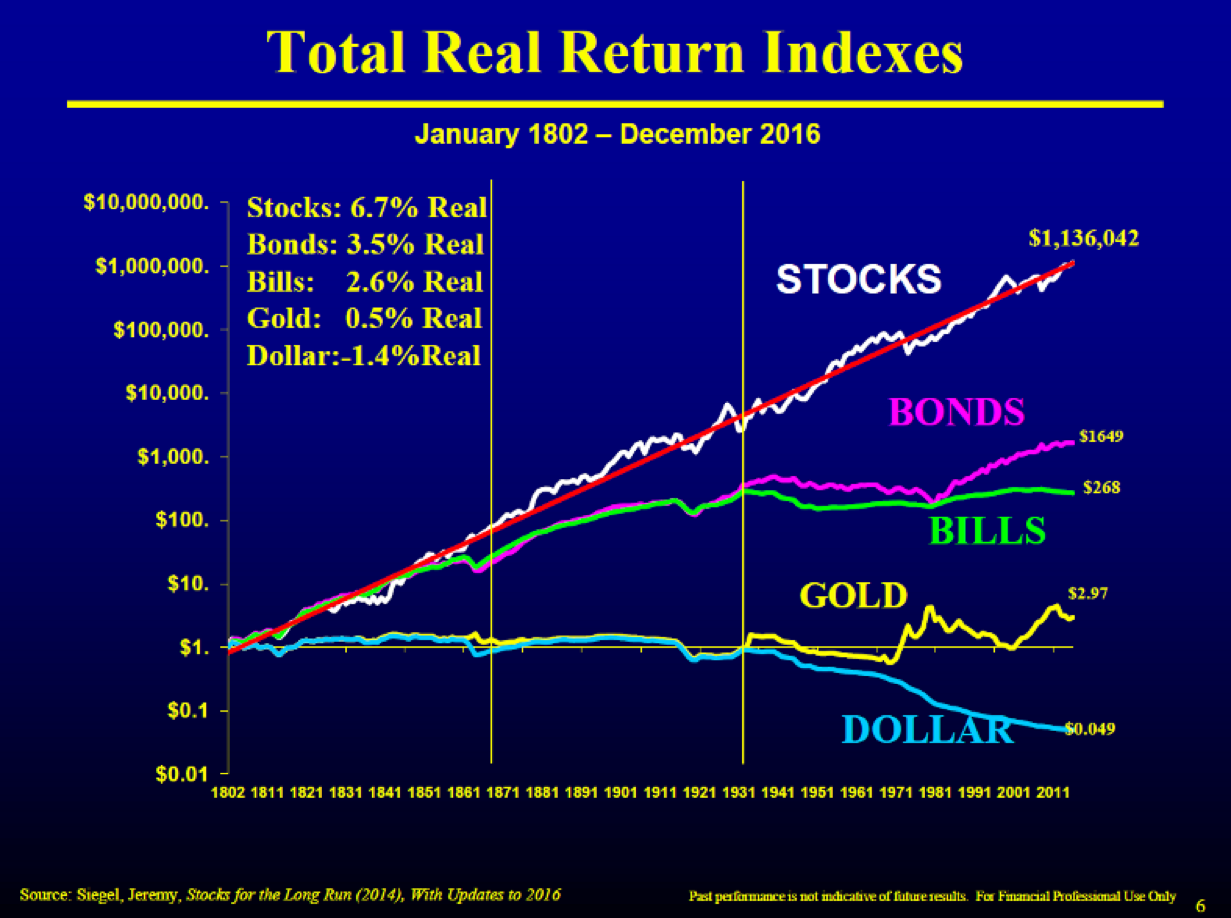

Stocks are the most profitable investment option on the capital market and defeat any other investment in the long term. It’s a well proven fact. However, investing in stocks also carries higher risks than investing in other investment components if you do not fully understand how to choose the right stocks and how to manage your portfolio in a wise way.

The good news is that successful stocks investing is not so complicated and does not require an advanced degree in business school or special mathematical skills. The only qualities required are basic accounting skills, critical vision, patience and discipline. Combining these features together with an understanding of how companies operate and how you measure their fair value will make you a successful stock investor. Don’t worry – we will learn all these things along this guide.

What are stocks?

Stocks are not just digital numbers that you see on your trading platform. A stock (or share) is in fact a partial ownership in a Company. In other words, in purchasing shares of a certain company, you join the owners of the company in its possession, and therefore you will be partners in its assets, debts and of course you will also be entitled to some of your profits in the form of dividends.

Obviously, you would not join as a partner in a lousy business, or a business you do not believe in its success. In the same way, it is not wise to buy shares of a company that you are not convinced of its future success. The reason for this is that the value of your holding in the company will rise or fall in the long term depending on the success or failure of the business operations. The better the company operates and the more cash flow it generates from its operations, the greater its value gets.

Buying your part of the company is not free. You will have to pay a price for each share you buy. Same as you prefer to buy discounted products, you will also prefer to purchase your shares at a cheaper price than their fair value. By buying your shares at a discount, you can achieve a higher return on your investment and avoid losses if you underestimate its value. To do that, you will have to understand how to reliably evaluate a company’s true worth using its financial data.

Is stock investing right for you?

Stocks are a volatile and unpredictable investment component in the short term. The price of a share may also remain constant or be in a downward trend over a longer period of several years, for example in light of a recession or deterioration in the condition of the market. Therefore, investment in shares is suitable only for investors who can invest their money in the capital market continuously over a period of at least five years (preferably ten years). If you intend to spend your money for a short period of time (for example, because you are planning to buy a house, pay tuition, etc.), you should avoid investing in shares because the time limit may force you to sell your shares at a temporary loss.

Even if you intend to invest for a long run, this does not necessarily mean that investing in stocks is appropriate for your character. The high volatility that often occurs in the price of stocks may lead to a significant reduction in the value of your holdings from time to time. An investor who chooses to invest his money in shares must recognize that even if he chooses his shares very carefully, he will be forced every few years to see the value of his portfolio shrinking by a considerable percentage, and without any possibility of avoiding it; This is due to the cyclicality of the stock market (on average, 4-6 years of uptrend and then a 1-2 years of down trend). However, if you are a patient investor with long-term horizon that can bare this high volatility you can invest even 100% of your savings in stocks, but if not, it is wise to limit the equity position in your portfolio. As a rule of thumb, subtract your age from 100, and buy stocks at this percentage and buy bonds in the rest of your funds.

How much can you earn from investing in stocks?

so, why invest in stocks?

The stock market is on a long-term up-trend, rising at an average annual nominal rate of about 8%-10% (this means doubling your money every 7-8 years). This has been the case for the past hundred years, and there is a probability that this will happen in the next hundred years as well. Therefore, any investor willing to tolerate temporary volatility in the value of his holdings and with the minimum investment skills mentioned above, can achieve satisfactory returns from his investment.

More successful investors, such as Warren Buffet, that actively manages a smart stock portfolio based on a relatively small number of the best stocks they find, can even yield higher returns up to 25% a year. You won’t become Warren Buffet over night, but if you acquire the financial education required for smart stock picking and manage your portfolio wisely, you will be able to achieve impressive returns over the years.

Read on to the next chapter: