The valuation method that is used by most value investors, analysts and fund managers to value assets is the Discount Cash Flow (DCF) method. Unlike the multiples method which is based on comparison with other companies, DCF valuation is based on the expected financial results of the company itself, thus it is the most reliable valuation method and gives the best estimate of the real value of the company.

Despite the fuzzy name, the main idea behind the DCF method is quite simple: each company is equal to the present value of all cash flows that are expected to be generated throughout its years of operation (‘present value’ means how much these cash flows are worth today. See further explanations below). To be complete, the cash and Equivalents on hand less the company total debt need to be added to the calculation. If the current stock price is lower than this fair value then the stock is considered cheap (undervalued), and if it is traded above this price it is expensive (overvalued).

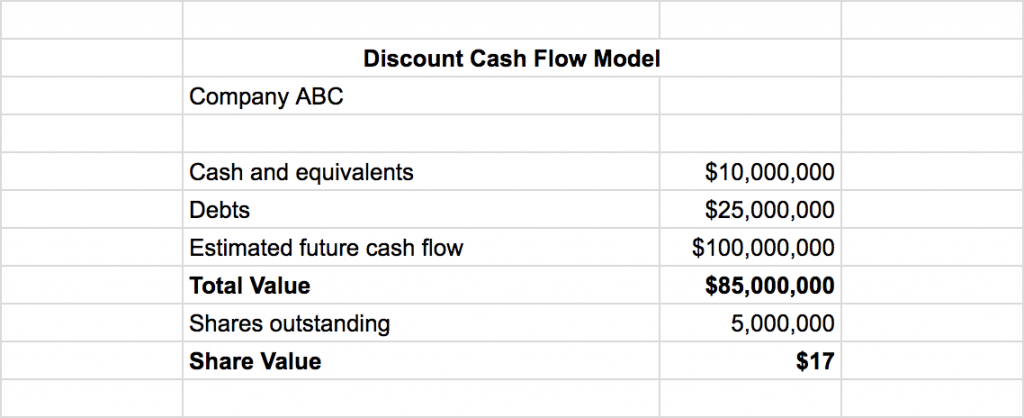

For example, if company ABC has $10 million of cash and equivalents, $25 million of debt, the present value of its future cash flows is $100 million, and the company has 5 million shares outstanding, then its fair price is $17 ( [10M – 25M + 100M] / 5M = $17 ). If ABC’s stock currently trades at $10 then it’s cheap and if it trades at $25 then it’s too expensive to buy.

Here’s a schematic representation of this model:

What are Free Cash Flows and why use it and not earnings to value companies?

Many investors, including analysts, attribute too much importance to the company’s profits, especially net profit (or Earnings Per Share). On one hand, net profits are indeed a measure of how much money the company earns after deducting all expenses from its sales. The problem is that these profits are not always translated to the real cash flow. Remember that company sale products deduct the recurring expenses and declare net profit. But customers usually pay in credit for the items they buy, thus the company didn’t yet collect all the money from its sales. This means that profits are recorded in the Income statement but no cash flow was actually generated from these sales. What if the costumer changed its mind and returns the item for a refund?

In addition, not all expenses involved streamline of cash. This is because a company also needs to buy additional inventory and sometime also new property, plant or equipment. All of these things cost money but are not included in the income statement, thus not reflected in net earnings. Therefore, a different measurement has to be used to evaluate how much cash the business actually generates. The Free Cash Flow (FCF) measures it very accurately.

The FCF starts with net income, add back all the expenses that doesn’t involved cash flows, such as Depreciation or deferred taxes that weren’t paid yet. It also deducts all the cash expenses that weren’t included in the income statement like buying additional inventory or fixed assets (expenses which are called Capital Expenditure or CapEx). The result is the actual net cash flow that was generated during the year. This is the amount of cash the company can use to pay its liabilities, invest in the business or pay dividends to its shareholders, and thus this is the parameter that values the fair worth of the business.

It may sound simple, but estimating the future FCFs and deducing the fair value from it is a more complex task that requires better knowledge of company analysis. However, after you have learned the process and gained enough experience in doing it, you have the power to know how a stock is currently priced.

Warren Buffett and many other Value Investors are using this method to choose their stocks and this is how they beat the market in the long run. I do the same in the LongRunPlan portfolio – I search for stocks that are traded deep below their fair price, buy them and wait until the valuation anomaly is closed. Then, I sell and replace it with a new attractive stock. By using this process I managed to beat the market big-time since 2001.

Read on to the next chapter: