Everyone knows that it’s not a wise thing to put all your eggs in one basket since losing the basket will be disastrous. The same rule of thumb is applicable for the stock market, meaning it is risky to invest all our money in too few stocks. The question is how wide diversification should our portfolio have; are 8 stocks like Warren Buffett and other gurus hold in their portfolios are enough or should we hold a much larger number of stocks than that?

To answer this question, we have to understand the two major risks when investing in stocks:

The market risk

Also called “systematic risk”, is the risk of losing money as a result of a macro event that is not directly related to the companies you hold. Sources for market risk include recessions, changes in interest rates, currency changes, wars, political instability and more. In these cases, even stocks of companies that will not be affected at all from those situations will probably drop down along with the rest of the stock market. Thus, unfortunately, there is nothing you can do to protect yourself from this global risk.

The company risk

The second risk, (also known as “specific risk”), is the risk of losing money from buying a stock of a company that something went wrong with it. For example, you bought a stock of a very promising technological company that is expected to launch the next generation fibers next year. Unfortunately, one of its competitors succeeds to produce and launch the same fibers 6 months earlier. Investors were obviously very disappointed and the stock dropped down 20%…

The company risk can be reduced by expanding your analysis of the company and the sector it belongs to before buying the stock, but sometimes things happen differently than what you expected. Thus, you can’t be 100% right in all your investing ideas, and in a few investments, you’ll lose money. This happens to everyone including Warren Buffett.

However, if we hold only one stock and it went down dramatically we lose a lot of money, but if we hold, let’s say, 20 different stocks at equal amounts, and one of them lost all its value, we still lost only 5% from our entire portfolio value. In other words, diversification is a great protection against the company risk.

Still, how many stocks should we hold to be fully diversified?

As we understood, too few stocks increase the company risk but on the other hand, too many stocks will make it difficult for you to achieve returns greater than market returns. The following simple test can help us understand what is the correct number of stocks required for a decent diversification.

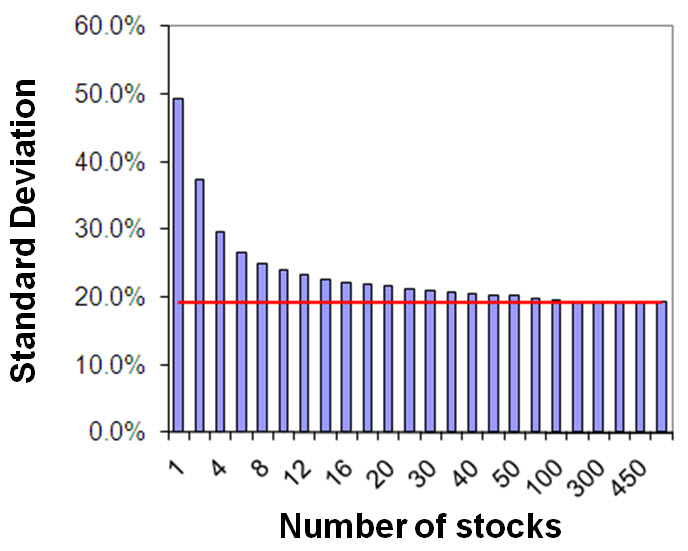

If you buy all the 500 stocks of the S&P500 index at the beginning of the year, sell at the end, and repeat this process for many years, your average annual return will be around 10% and the standard deviation will be around 20%. Statistically, this means that in every 2 out of 3 years your annual return will be in the range between 20% higher (30%) and 20% lower (-10%) than the average return. In other words, the US market volatility is 20%.

If you do the same procedure but instead of buying all 500 stocks you randomly chose a single stock each time, your portfolio volatility will be almost 50%. This is more than double the market volatility and is definitely too high for most investors.

However, as can be seen in the image below, as the number of stocks increases towards 12-20 the volatility sharply decreases to only a few percentages above the market volatility. This means that buying more than 12-20 stocks will not make your portfolio more immune from market volatility.

Indeed, looking at portfolios of successful investors like Warren Buffett and other gurus, you see 8-15 stocks, which is the correct diversification. Contrary, equity mutual fund managers do wrong by usually including more than 50 stocks in their funds, reducing the portfolio volatility by a bit but prevent them to beat the market. Actually, their net return after deducting management fee usually drop below the market return.

To summarize, if you’re a novice investor without an extensive experience, it is therefore wise to include around 20 stocks in your portfolio, investing an equal amount of money in each stock. The richer your experience and the more thorough analysis you perform, the fewer stocks you need to hold (but probably not less than 12 stocks) and even invest a larger amount of money in your best ideas. Buying 12-20 stocks will give you the potential to make higher returns above the indices while keeping your eggs in different baskets and protecting you from larger losses in case you bought few mal-performing stocks.