According to the Russian administration’s decision in April, all shares of Russian companies traded on stock exchanges outside the US must be delisted. The deadline for that seems to be August 3rd, thus if you want to keep your shares you must transfer them to a Russian broker.

If you bought Gazprom at $2.85 per share as I did, your return is currently 166% 300% as the Moscow share is traded a 244 299.5 rubles, equivalent to a share price of $7.6 $11.2 (each unit traded in the US or London is equivalent to 2 units traded in Moscow). Thus, it is worth the effort.

* Update: September 29, 2022 *

BNY Mellon re-opened their books again (see here) so you can try converting your ADRs through your broker to your Russian account in Gazprombank. You can ask your broker about it.

If you prefer to go with the mandatory conversion via Gazprombank as I described in the previous update, you should know that the Russian parliament postponed the deadline to November 11, 2022, so you have more time for that.

* Update: August 15, 2022 *

According to Gazprom announcement, DR holders can now request a mandatory conversion of their DRs to common shares that will be traded in Moscow. The shares will be stored in a Russian account in Gazprombank that will be opened only for this purpose.

All the details and the forms can be found in this FAQ letter and in Gazprombank site.

Keep in mind that you or a representative of you must submit the paperwork by hand at Gazprombank office in Moscow before October 11, 2022. The actual shares will be given to you on October 25, 2022, if you completed the submission before the deadline.

There are a couple of Russian lawyers that can handle that process for you, but their retainer is above $5,000, which is probably costly for most of you.

If you don’t convert your shares before the deadline, they will not vanish. BNY Mellon will try to sell it for you on August 2023, but it’s not guaranteed to work or it can be worth pennies.

I’ll post more updates if anything changes.

* Update: July 15, 2022 *

Russia adopts a draft law allowing DR conversion without the need for a Russian broker or bank account. This means that your broker will probably be able to convert your DRs to common shares inside your account.

See the details here.

Israeli banks are already allowing this conversion and I hope other brokers around the world will allow it as well in the near future. Interactive brokers allow conversion of a few Russian DRs and I hope they’ll allow conversation of Gazprom DRs soon as well.

I suggest that you send your broker this information and ask him about this issue.

* Update: Jun 28, 2022 *

After a long discussion with a Russian law firm that managed to convert Gazprom ADRs into common shares traded in Moscow, I understood that it’s currently better to keep Gazprom DRs and ADRs in your own broker account and not transfer them to Gazprombank.

This is because the Gazprombank account is a limited account, and in order to sell the shares and transfer the money to your bank account you need a regular Russian bank/broker account, which is currently very hard to open.

In addition, money from Russia can only be transferred to “friendly countries”, and the US and Europe are not such countries.

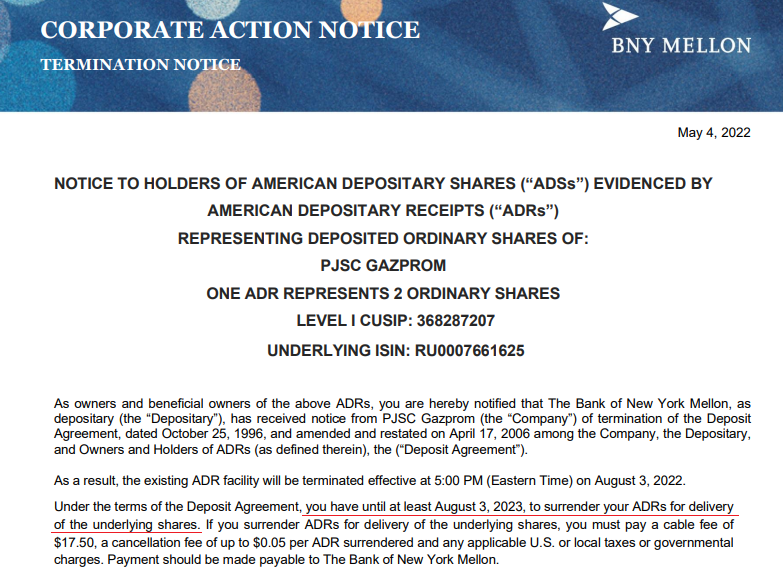

However, according to BNY Mellon publication, the deadline for converting the ADRs to common shares is at least until August 3, 2023. Until then let’s hope that the Ukrain war will end and the sanctions on Russia will end too, and we will be able to convert the ADRs easily.

Keep in mind that this is my decision that is based on my understanding of the situation, and I could be wrong, so do what you think is right.

* * *

How to convert the ADRs to local shares traded on the Moscow stock exchange?

All the details are in Gazprom’s publication here (in Russian, translated into English with Google):

https://www.gazprombank.ru/docs/drcancellation/

(You can download a PDF version of the above page from this link if the website doesn’t load)

Please note: I am not a legal expert, I do not know in depth the details of the sanctions on Russia, so the things I am writing here are based on my personal understanding of Gazprom’s publication. I recommend that you read things carefully before submitting the forms.

Step 1: Open a Russian account to transfer the shares to

Assuming you are not a Russian citizen and do not have a bank account in Russia, the next step is to open a sort of dedicated account only for storing the shares in Gazprom’s bank (yes, Gazprom also has a bank…). This is called a depo account of type C.

To do this, fill in one of the following questionnaires:

Questionnaire 1 if your trading account is a private account.

Questionnaire 2 If your trading account is registered under a company name.

US citizens should also fill out this W-9 form.

and send it to Gazprombank to this email address:

After the account is opened and you get the account number you can move on to the third and final step.

Step 2: Contact your broker and ask to transfer the ADRs to you Gazprombank account

Contact your broker that currently hold the Gazprom shares for you and ask him to submit a request to transfer your units to the Russian Depository Trust Company (DTC) to an account with the following details:

Member number: 2504

Account number: 016201

Operation type: FOP

Step 3: Contact the custodian and ask him to convert the ADRs to common shares

Send the following two forms to BNY Mellon (the custodian of Gazprom ADRs) at the email address after you have filled in your details in the required places DRsettlements@bnymellon.com :

In Appendix 2, fill in the following details:

Russian Issuer: Gazprom OGZD for London ADRs or Gazprom OGZPY for US ADRs.

DRs Canceled: the number of units that you hold in your account

DR ISIN / CUSIP: in London US3682871088, in USA US3682872078

Executing bank / broker-dealer: The name of your broker

Account receiving Shares in Russia: Write down the account number you received at Gazprom Bank

Date: the settlement date for converting the ADRs.

I will keep you updated if there are any new developments.

112 Comments on "How to convert Gazprom ADRs and other Russian DRs to local shares"