Electric vehicles are certainly the future of the automobile market, but does this justify that Tesla will trade at a market capitalization of $277 billion? This is larger than the combined value of Toyota, General Motors, Fiat-Chrysler, Ford, and BMW together…

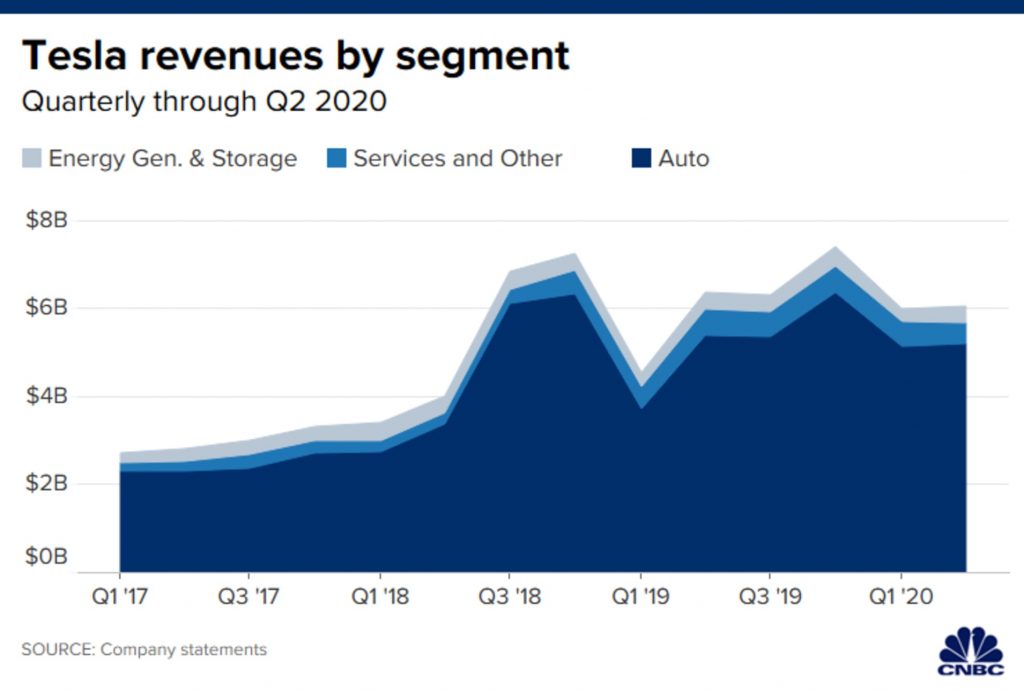

Well, the good news is that the automaker announced that it made $6 billion in revenue and reported a small $104M GAAP net income ($451M non-GAAP net income).

The bad news for investors is that Tesla is currently traded at a whopping P/E of 717. Thus, the company needs to grow tremendously in the next few years to justify its ultra-high valuation. But looking at recent quarters it seems that the growth rate is close to zero and net profit is still too low.

Tesla has other activities as well, but they probably won’t increase its revenue dramatically in the coming years, thus in the near future, Tesla should be considered as an auto company. It might be a revolutionary one, but it’s still a car manufacturer.

A typical automaker earns between 5-10 cents on each 1 dollar of revenue and trades at a market cap 5-8 times larger than its net income. Even if we agree to value Tesla at P/E of let’s say 20 like a technological company, and we assume it can earn 10 cents for each dollar of revenue, the company needs to generate revenues of $138 billion to justify its current valuation. This is almost 6 times higher than Tesla sales in the last 12 months.

Is this a feasible outcome?

Elon Musk’s fans are confident that its electric vehicles represent the future, and that Tesla’s profits are expected to grow in a way that will justify its insane valuation. But they ignore the fact that there are other companies in the world that produce electric vehicles, which do not fall short in quality from those of Tesla.

They also ignore the series of fatal accidents that were allegedly caused as a result of malfunctions in the autonomous driving ability of Tesla cars, and their tendency to ignite spontaneously.

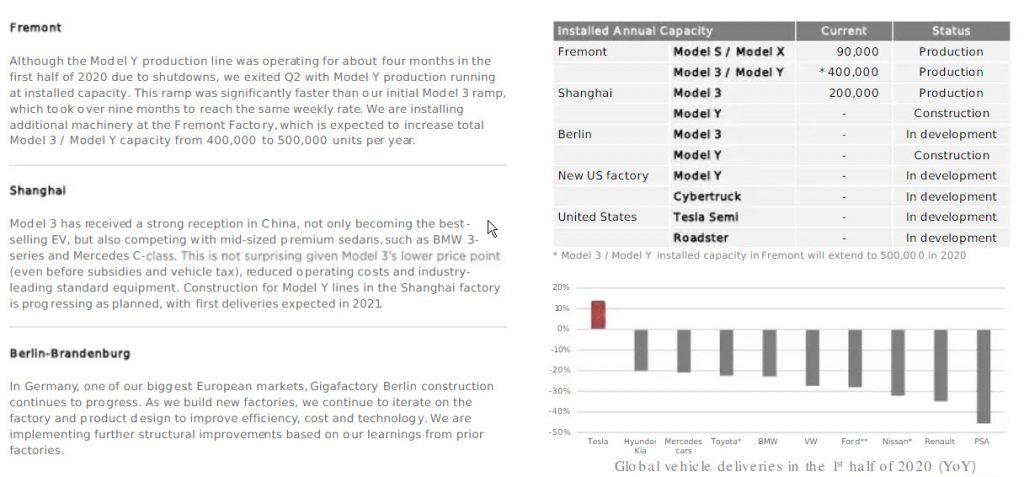

If an average Tesla car is sold for $40,000, which is a relatively expensive price for a car, then it has to sell around 3.5 million cars to generate $138 billion in revenue to justify its valuation. Currently, the company sells only around 90,000 cars a quarter. This number will probably grow but the operational factory in Fermont is only capable of manufacturing 500,000 cars a year. The Shanghai factory can make maybe 500,000 more and even if we add the new US factory and the Berlin factory which are in development, Tesla manufacturing annual capacity will grow to about 2 million cars a year. Tesla will have to build at least 4 more factories to get to 3.5 million cars capability. This will take time and a lot of funding.

The thing is that Tesla has $3.6 billion of short-term debt it needs to pay this year and $10.5 billion of long-term debt, so the company is already flooded with debt. Borrowing more money for future factories could be challenging.

Bottom line: avoid the stock but don’t short it

Most institutional investors probably agree with us that TSLA is overvalued since it’s the most shorted stock on the S&P500 and with a large difference above other index companies.

The bottom line, Tesla stock went too high and I suggest you avoid buying it. On the other hand, it’s a “crazy” stock so don’t short it – it’s too risky.

Be the first to comment on "Should you short Tesla stock?"