The last time (and only since the launch of the portfolio in 2004) that we saw a negative annual return in the portfolio was in 2008 (the portfolio went down 16.5%, much less than the -38.5% drop of the S&P). Since then, we have seen a strong rally in the markets, yielding very nice returns to our portfolios, but also led most stocks to fairly expensive valuation. It’s nothing new. This ritual repeats itself in every market cycle. However, despite the volatility, the leading indices are at a price level similar to the one they opened the year while the portfolio has lost more than that.

What is the reason for the large gap between the portfolio and the leading indices this year?

If you go through the portfolio, you’ll see that it has exposure to a wide range of sectors: investments and insurance, data storage – one of the hottest areas today, communications, energy, real estate, automotive, infrastructure, and biotechnology. From the valuation perspective, the shares in the portfolio are all traded at significantly lower valuations than the average in the market and compared to the average in their sectors, so the reason for the sharp drop in the portfolio does not come from dependence on a particular sector that has been hit or from high valuation levels.

In my opinion, the main reason for this gap is the investors’ run toward the large stocks, mainly the defensive ones. It’s natural. When investors fear, they are entrenched in shares of the big companies, which they believe are safer. The result is a more moderate decline in the leading indices relative to portfolios based on shares with lower market caps. Strong evidence of this can be seen from the fact that the small companies index on Wall Street (Russell 2000) also fell by about 10% YTD, a much larger decline than that of the large stocks.

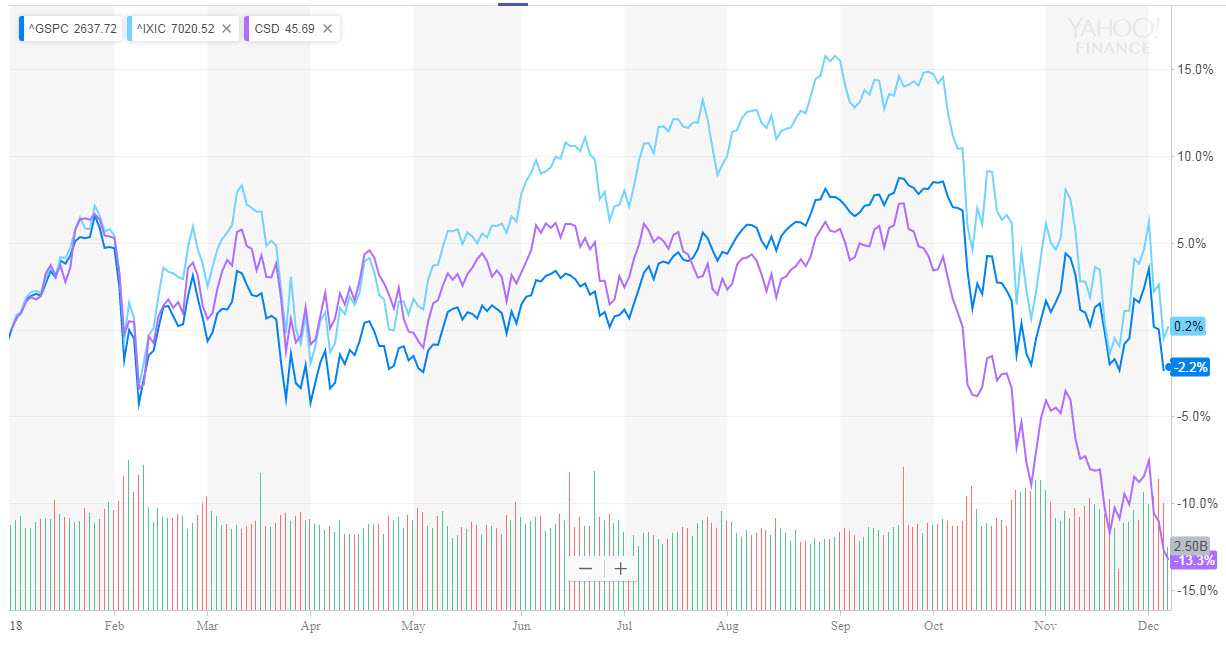

(S&P500 in blue, Nasdaq in light blue, and CSD in purple)

In addition, spin-off shares are known for their anonymity and limited historical financial data, making it difficult for investors to correctly estimate their fair value at the initial trading period. This is one of the reasons why larger price distortions are created that can be exploited at the beginning, but on the other hand, it sometimes pushes their price down more strongly in times of fear as there is today. As evidence, the Invesco S&P Spin-Off ETF (CSD) lost 13% this year, larger than the decline in the portfolio.

Is the market still expensive?

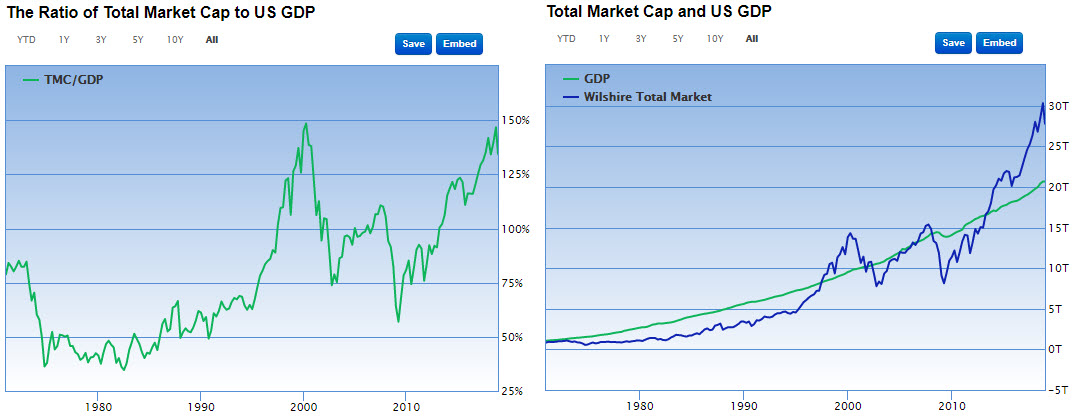

Overall, the US stock market is still trading in a relatively expensive territory (but it’s not a bubble), at least in comparison to the past. The S&P500’s average P/E ratio is currently 21.5, at least 10% higher than the price level it should trade based on US growth and interest forecasts (and after adjusting the distortion of the FAANG stocks on the multiplier). Warren Buffett’s market value to GDP indicator also indicates expensive valuation. The US economy looks good, but not in a way that justifies such high valuation, so I would not be surprised if the indices lose another 5-10% of their value. At the beginning of 2019, I will post a more detailed review of the market valuation and my forecasts for the coming year.

Source: multpl

Source: gurufocus

So, should you stay (invested) or should you go?

Predicting the future is not my strong area, but history has taught me again and again that holding a diversified stock portfolio traded below their fair value is likely to beat the market in the medium and long-term. This time too, in the short term, we will continue to see high volatility in the market and in our portfolios, maybe even a few more percentages down, but five years from now, when we look back on this period, we will smile and admit to ourselves that we succeeded in keeping our investment in a balanced and patient manner.

Actually, if you listen to my advice and kept 15%-20% of your investments in cash, you are well positioned for this bearish period. This cash will be used to buy new shares at very attractive prices, which will also assist the portfolio to beat the indices down the road.

4 Comments on "Why undervalued stocks are going down in 2018?"