2020 was a very challenging year. It opened with the outbreak of the corona in February, which knocked the markets down 35%. Fortunately, the portfolio had a strong cash balance at this time, so I was able to purchase new stocks of solid businesses at a large discount to their fair value, and it pushed the portfolio up impressively when the uptrend of the stock market arrived.

It wasn’t easy to buy new shares in March when COVID-19 just started and the market collapsed, but it proved again the well-known mantra of Baron Rothschild that “you must buy when there’s blood in the streets.” and it worked great…

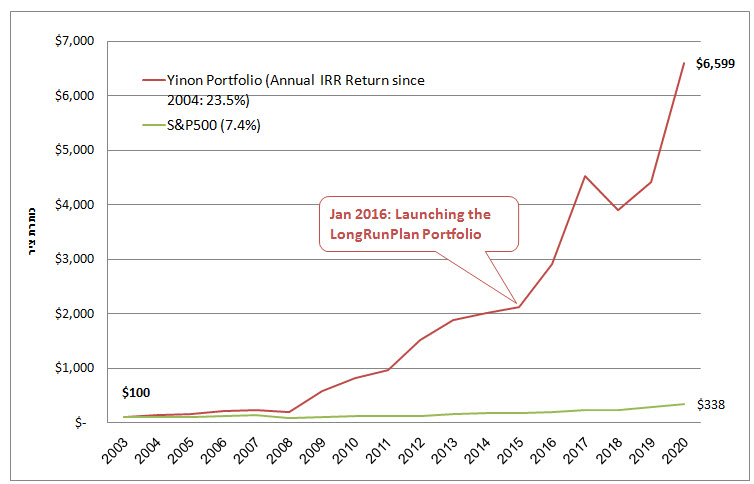

The portfolio skyrockets 49.3% in 2020 compared to the S&P500 index which climbed 16.3%. Since its launch in 2016, the portfolio has yielded an average annual return of 25.6% (The portfolio was actually launched in Hebrew in 2004, and the English version was initiated in 2016). I am proud that this was done through investing in quality companies, with a relatively low-risk profile, and not through the pursuit of dream stocks, which may or may not succeed.

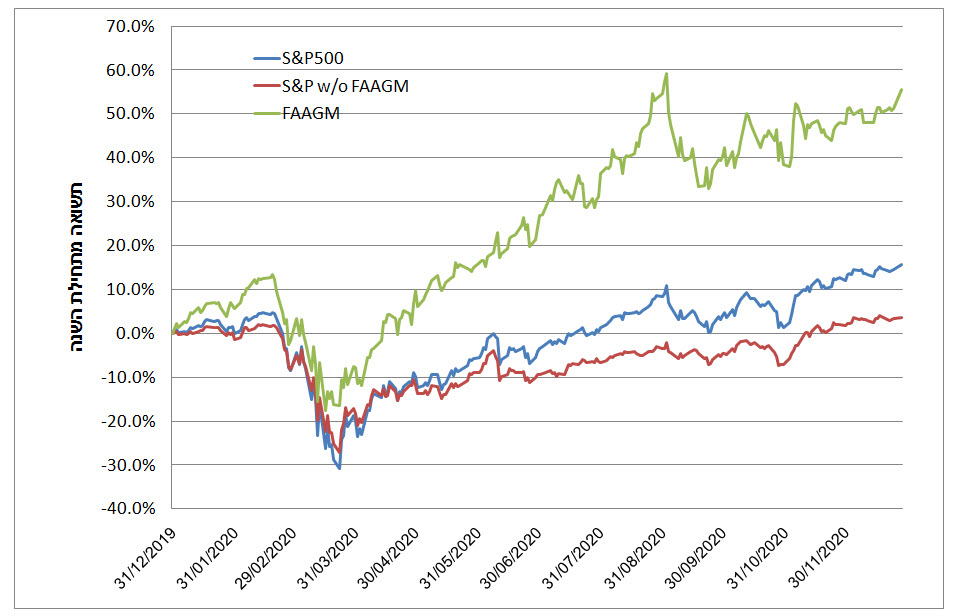

A very interesting point is the significant gap between the technological stocks, which soared and pushed the indices to such a positive return, and the “old generation” companies and sectors affected by the lockdown, which some of them are still well below the price they were at the beginning of 2020. Some will never return to the price levels they presented in the past.

In fact, without the 5 giants – Apple, Amazon, Microsoft, Google, and Facebook, the other 495 companies in the S&P500 rose on average only by 3.5% this year. Most index investors are unaware of this fact, so they do not understand how much their investment depends on these 5 giant companies, which probably won’t climb up forever as they did in recent years.

What is expected for the market in 2021?

Although many Wall Street stocks are trading at un-reasonable valuations, the current economic environment will continue to be very supportive of the stock market. The low-interest rates, the fact that there is a lot of money outside the market (in bonds and deposits) and there is no other alternative than stocks, the millions of new investors joining the market every month and are willing to buy everything at any cost, the rapid technological changes the world is going through – all these things and others will continue to push stocks further up, so I’m very optimistic about the stock market in the foreseeable future.

Despite the optimism, I still think it is reasonable to keep a cash balance of 10%-20% to be able to buy new opportunities that will arrive in this volatile market.

I wish you all a healthy and successful year!

Be the first to comment on "49.3% for the LongRunPlan Portfolio in 2020"