After a 35% collapse from its mid-February high, the stock market suddenly changed direction and rose more than 20%. US indices are still about 19% below their peak, but why stocks are rising when people continue to die from Corona all over the world?

Well, the stock market is a compass of the economy.

Stock market investors are not looking at what was or is happening now, but are valuing shares according to what they believe will happen in the future.

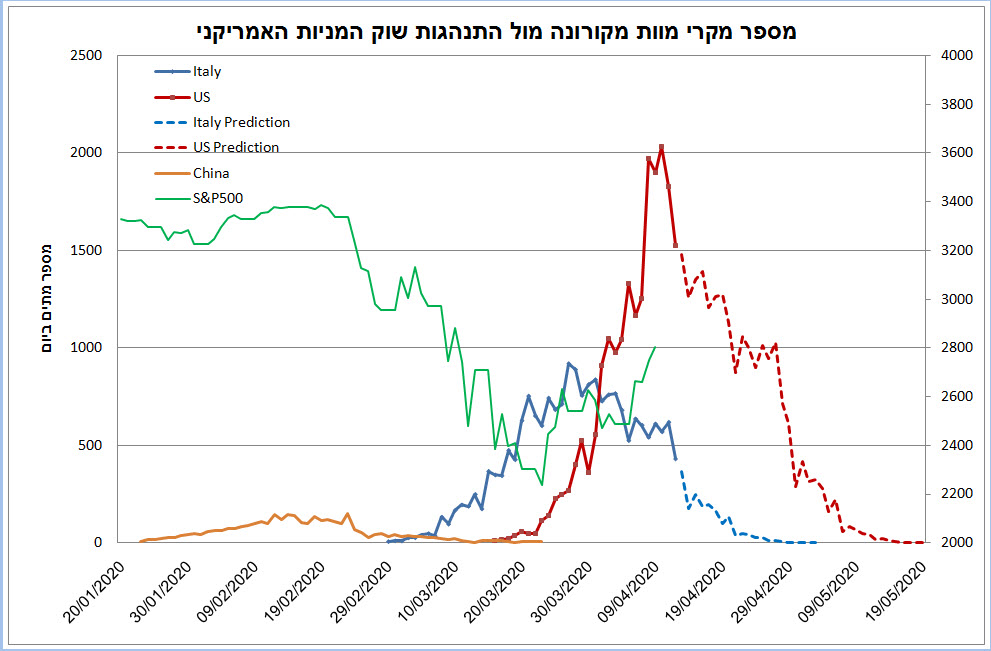

The chart below proves this.

(notice that the future number of deaths shown in the chart above is just a simple prediction in accordance with the increase in the number of cases so far; the actual numbers could be vert different).

In the last week of January people started to die from Corona in China (the orange line in the chart shows the number of dead in China). But investors haven’t been excited about it yet. Trump, too, was still euphoric that everything looks very good (WOW, he’s the worst market timer ever…).

But when investors realized that the virus was also infecting people outside of China, in Italy, for example, they panic and started selling shares. The declines become worse as people began to die in the US as well.

Then, on the last week of March, when the number of deaths in China dropped to almost zero, it turned out that the Corona could be taken over, the optimism returned and stakeholders (the owners of the companies and its managers) and smart investors returned to buy shares (I wrote about it here). I also notify you that I have started to buy as well.

The market soared.

Although this pattern is repeated in every crisis, no one could schedule it. Unfortunately, I also don’t have the ability to schedule bottoms, but I simply bought because stocks were pretty cheap, and that was part of my plan to enter the market in several portions.

Can Trump and the Fed continue to push the market up?

In November, Trump is going to the presidential election and he doesn’t want to lose.

For that to happen, he needs the US economy not to go into a recession and the stock market to continue to show a positive trend, and he’s ready to do anything to make it happen; even if he had to print endless dollars and rescue failed companies.

Most recently, he pushed the Fed to announce a $2.3 trillion bailout program (!) to help US companies to survive the shut-down. These include companies from tourism, aviation, industrial, real estate and more sectors.

In recent days, the Fed has even stepped up to announce that it will start buying corporate bonds with low credit ratings. Not US government bonds like he did in the post-2008 quantitative easing (QE) program, not high-rated corporate bonds like the ECB is doing in the last few years, but bonds of high-leverage companies that are in financial risk.

The Fed probably knows that a substantial portion of that money can go down the drain, but he has no choice if he wants to keep those companies head above the water.

In the medium and long term, it is not certain that this will help the economy, but in the short term, it is like a corona patient who is connected to a ventilator and can survive for a few more months, until the elections.

This pushed both stocks and bonds up and led to the rally we have seen in recent weeks.

Can the rally go on?

Just as your car can continue to travel for a few tens of miles after the fuel red light goes on, so too can the stock market go up if investors feel confident that Trump and the Fed will rescue any company that is facing difficulties.

But with a broader view, it should be borne in mind that the stock market reflects what is happening in the economy itself, so the strength of the hit and the economic recovery forecast is what will determine the stock market behavior down the road.

At the moment, it’s hard to predict what is the real condition of the global economy since it’s covered with dust clouds flying in the air like the dust after a plane drops a huge bomb on the ground. Only after the dust will dissipate, the damage done can be estimated.

This will happen after the shut-down from the Corona ends.

According to the data that is beginning to accumulate, the main casualties appear to be small and medium-sized businesses, but obviously there will also be larger companies that will find it difficult to survive. In the coming weeks, we will begin to see the first quarter financial statements of leading companies, so that data will start to flow.

So how to invest now?

Despite the short-term uncertainty, our outlook should always be on what will happen a few years from now. The corona is not the end of the world and in a few years, the world will (probably) look quite similar to what it looked like before the corona erupted. People will go to work (maybe a greater part of them will work through Zoom), we will fly overseas, go to the mall, sit in cafes, meet friends, the kids will go to school and all the other things we did before the Corona arrived.

Therefore, my focus is on companies that will successfully pass the crisis and later on will emerge stronger. In addition, I focus on stocks that trade at a deep discount below their fair price. All the stocks in the portfolio are traded at very depressed multiples compare to the broad market.

In the next few quarters, their financial results are likely to be hurt like most companies, but later on, they will return to be profitable as they earn on routine days, and then investors will have to value them accordingly.

In other words, in the near future, anything can happen – the market can rise or fall randomly according to Trump’s tweets and other noises around the world, but down the road, the logic will prevail and shares will be priced according to the economic value of their companies. I estimate that it will be at least twice the value the companies in the portfolio currently have.

In any case, the portfolio also has a sizable cash balance (around 20%), which I intend to use to strengthen some of the existing positions if there are further declines and probably also to buy a new share or two that went down unjustified because of the Corona.

Take care and invest patiently.

Be the first to comment on "Is the current stock market rally sustainable?"