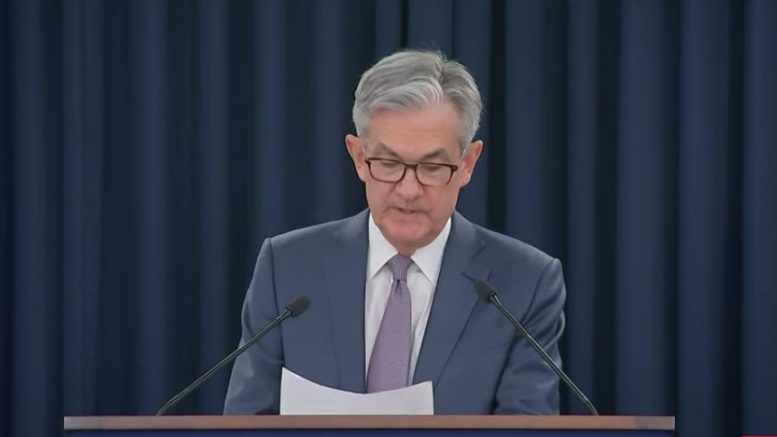

Just two weeks ago the Fed declared that interest rates will not change in 2020, but yesterday he surprised everyone and cut rates by 0.5%. He said that the fundamentals of the US economy remained strong but the spread of the Coronavirus poses a significant risk to the economy.

This is a substantial change to the Fed’s forecast a few weeks ago. It is also a very unusual decision in both timing and intensity. The last time an interest rate cut has performed before the Fed committee meeting was in October 2008 after the collapse of Lehman Brothers.

Are we in a pre-recession period again or was the Fed overreacting?

I think he was very pressured by the negative developments in the stock market and Trump’s tweets against him and responded unreasonably. As evidence, investors were also alarmed, and after lowering the interest rates, the indices have gone down (usually lowering interest rates is good for stocks and the indices should rise).

Moreover, according to the drop of yields in the US bond market, investors do not seem to be satisfied with this cut and expect a further reduction in the near future. The US 10-year treasuries are currently trading at less than 1% yield-to-maturity, something that has not happened for many years.

Will the Coronavirus really hurt the global economy?

YES.

The shut down of most of China and the limited movement of people and goods around the world will surely hurt the economy. The question is how severe and for how long.

In the short term, many companies will be hurt. Those in the tourism sector – airlines, cruise companies, hotels, and others are already feeling a halt at reservations and this will be reflected in their financial results in the coming quarters.

Shares of these companies have collapsed in recent weeks and reached a very interesting valuation level.

One of the interesting stocks, for example, is the cruise company Carnival Corporation (CCL), which has dropped to a historically low P/E of only 7.5. On the other hand, the company has billions of dollars in debt that it could find difficult to serve in the near future if there is a substantial drop in profits. Therefore, you should not hurry to buy stocks from these industries.

Personally, I prefer to focus on companies whose shares have dropped sharply but are free of significant debt. Many of the stocks in my portfolio are like that.

Companies from other sectors are also likely to be hurt. At the moment, most analysts expect the coronavirus effect to eliminate any expected growth in corporate profits of 2020. There are even analysts who estimate we’re going to see a recession in the US.

The US banking sector is also likely to be hit by the expected decline in interest income, and I would love to return to investing in bank shares if they are down to more convenient valuations.

Bottom line, it’s hard to know the level of damage the Coronavirus will do, but one thing is for sure (or at least very likely) – there will be a solution to the virus widespread and the world will return to the growth that characterized it before the Corona eruption. It may take one quarter, six months, a year and maybe a little longer, but it will happen.

Companies that based their activity on too large loans will find it difficult to function in the near future and will decline, and high-quality, profitable companies will survive this bump and continue to succeed normally in the long-term.

Will market declines continue or should you start buying?

The declines in the past week are very reminiscent of the sharp declines at the end of 2018. Then, the indices have dropped about 20% from the high and this time it is down about 12% so far.

Such declines are not unusual. A historical look at the maximum rate of decline within the year in each of the last fifty years shows that every year there is a 5% decline, every two years there is a 10% decline and every 6-7 years there is a decrease of 20% and more. The average inter-annual decline is 15.8%, so we’re close to the average.

However, no one knows what the depth of the current decline will be, so it makes no sense to try to schedule it. Alternatively, the right way is to buy into (during) the declines, which is what I intend to continue to do.

You don’t have to rush to buy everything at once – the high volatility will continue. At these moments, for example, the US futures suggest that the indices will jump up today, this time because of Democratic candidate Joe Biden’s victory (in my estimation he will lose to Trump in the upcoming election), but who knows, maybe later another news pop up and push the indices down.

Therefore, I’ll continue to use the cash on hand to buy shares during the declines.

Do yourself a favor and stay away from the computer screens and trading systems in the near future. This will help you manage volatility without reckless trading. It will pay off big time in the long-run.

Be the first to comment on "Was the Fed overreacting with the rate cut?"