2019 finalized the second decade of the 21st century. A decade that opened after the acute crisis of 2008 and the prolonged recession that followed. The flow of trillions of dollars by central banks around the world supported the recovery in most places, but not all of them.

The biggest success was in the US, which has rebounded impressively and with the leadership of President Trump, it continues to be the world’s leading economic power. China also continues to grow, but at a much slower pace (about 6% per annum) and still has plenty of problems that may hinder its growth down the road. Europe is in pretty bad shape and so are many of the emerging markets.

Why the stock market went up so strongly this year?

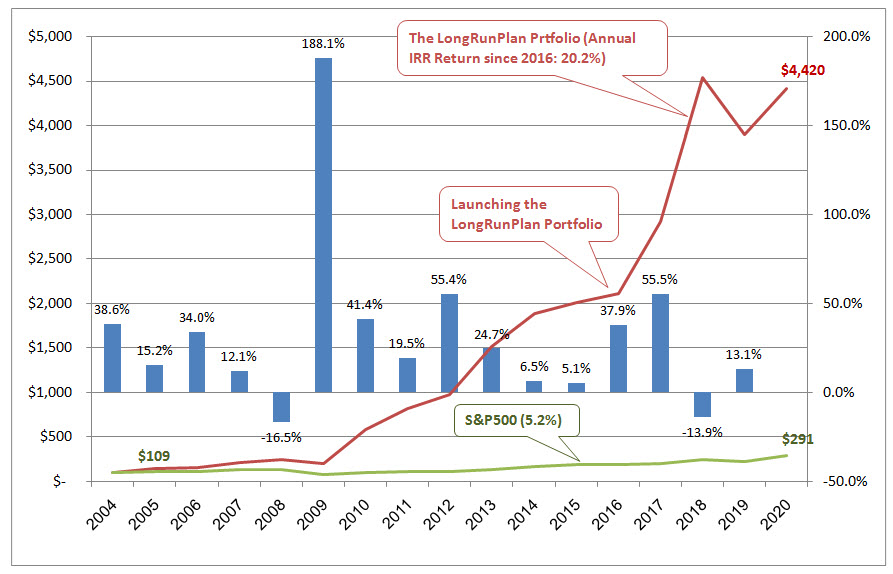

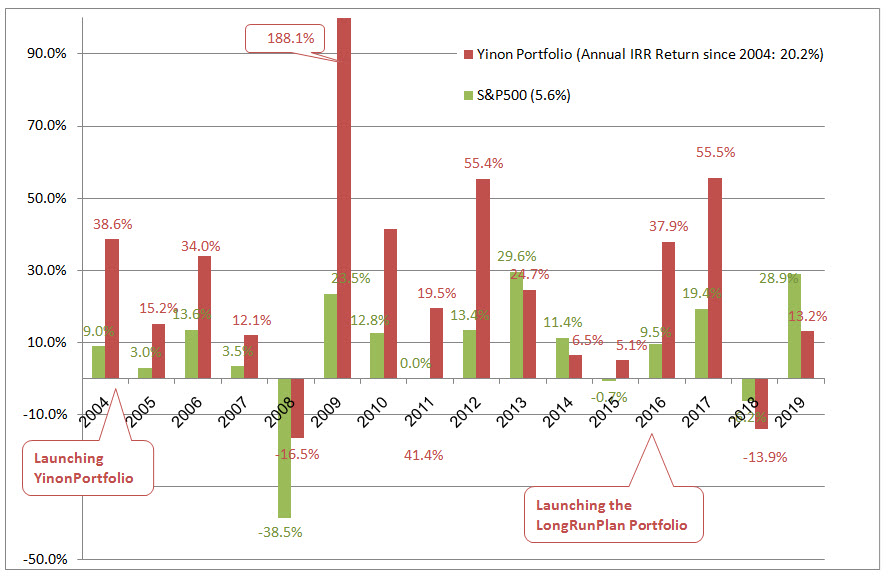

Surprisingly, 2019 was one of the best years for the capital markets in the world, both for bonds and certainly for stocks. The S&P 500 rose 28.9% and the NASDAQ went up even more sharply. Despite the celebration in the markets, the portfolio rose “only” 13.2% this year. On the one hand, it is disappointing – we all want to beat the indices, but on the other hand, it is clear that the indices cannot be overcome every year, and in addition, it is still a very nice return that is above the average return of the indices (9% per year).

Since launched in 2016, the LongRunPlan portfolio yielded a compound average annual return of 20.2%, much higher than the 5.6% of the S&P500.

What didn’t work this year and why?

many stock ideas in the portfolio did quite well, but some went down and it’s interesting to check why it happened.

Over the past year, we have seen more strongly the changes that have occurred to investors. First, they are running toward passive investments like ETFs, which not only fuel the continued upturn in the market but mainly push the stocks that are in the leading indices at the expense of smaller companies, even if their stocks are trading at unreasonable low valuations.

Second, investors were running away from the traditional non-technological areas or those related to industries that may be replaced by new technologies. A good example is GTX, which produces turbochargers for car engines. This component is crucial to improving engine efficiency in gasoline-powered or hybrid cars, but those who believe that in the near future engines will switch to electric ones are moving away from investing in such a company.

The thing is, the batteries of electric cars are not only expensive but still not strong enough to travel for long distances. This is particularly problematic in light of the fact that there is still no wide deployment of electric charging stations. The recharge itself is also quite long, and it is unlikely that you will wait an entire hour at the recharging station before leaving again. Because of these drawbacks, electric cars are still more expensive than regular cars and constitute only a small percentage of the total number of cars sold worldwide. But for most investors, the facts don’t matter and they prefer to invest in companies like Tesla Motors and price them in extremely high valuations.

Another example is in the traditional polluting energy sector, which was one of the weakest sectors this year, especially the shares of coal miners. Here, too, it is clear to all of us that the alternate energies will not completely replace coal and oil in the coming years and probably not even in the next 20 years. It is true that there will still be traditional energy companies that will face difficulties due to the decline in their income and the difficulty of serving their debt, but there will also be ones that will continue to succeed.

Take the coal miner CEIX for example. The company generates an annual free cash flow of about $100 million and trades at a market value of only $380 million. This means that within 4 years, it will generate more cash than its value (without taking into account the debt). The company is among the most profitable in the field, so even if coal prices go down further, which is unlikely in my opinion, it will remain among the last to survive and enjoy nice revenue over the years. Do you really believe that companies will stop producing electricity from coal in the next 4 years? In my opinion, no, that’s why investors are wrong when pricing CEIX so low.

So what we are required to do to adjust our portfolio to the changing stock market?

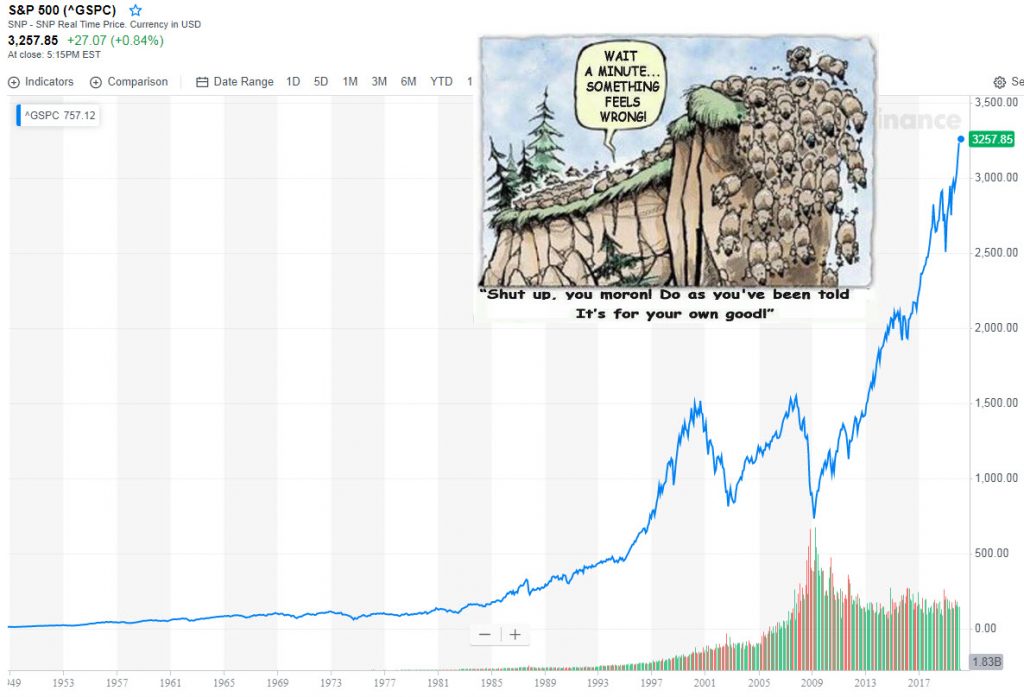

The S&P500 trades at a Price to Earnings multiplier of 24.4 and the Nasdaq shares trade at even higher multipliers. Anyone who is capable of investing in such expensive stocks is welcome to buy an ETF that tracks the S&P500, and pray for the rally to continue without falling off the cliff sometime in the future when investors return to be rational again (by the way, I’m not implying a near collapse because I don’t see the trigger for that, especially in the zero-interest environment around the world and the lack of equity investment alternatives).

I don’t like to buy expensive stocks and I guess you don’t either. So, I plan to continue to invest in a similar way to what I have done to date and have worked pretty well. That means focusing primarily on the U.S. market, investing in value stocks that are trading below their fair value (not necessarily spin-off shares). In addition, I will be more focused on finding growth stocks that are traded at reasonable prices (like CONE), which will continue to flourish and increase their value over the years.

In terms of the trading activity itself, I will place more emphasis on partial realization of positions after a sharp rise in a short period and increasing positions in stocks that experienced a sharp and irrational decline. Don’t expect a substantial increase in the transactions in the portfolio – this will not happen, but only a few more buying and selling orders above the average low number of transactions per year.

Have a happy and successful year!

3 Comments on "2019 summary: Another successful year for the LongRunPlan portfolio"