Once again we are experiencing a period of market declines. Not easy, especially when you know that your portfolio is composed of shares of high-quality companies that trade deeply below their fair price, both absolute and relative to the market average. It’s also frustrating to see the behavior of the portfolio over the past year and to realize that just three months ago, it had a return of over 20% since the beginning of the year.

Fortunately, most of you are probably already familiar with the way the market is behaving, so you manage to keep investing without selling any positions even during this negative period. Still, let’s understand together where are we in terms of market valuations, why the leading indices are relatively stable compared to stocks in the portfolio even though they are quite cheap, and finally – what should we do in a time like this so we will successfully pass this volatile period and come out with a satisfactory return over the years.

Is the stock market really expensive?

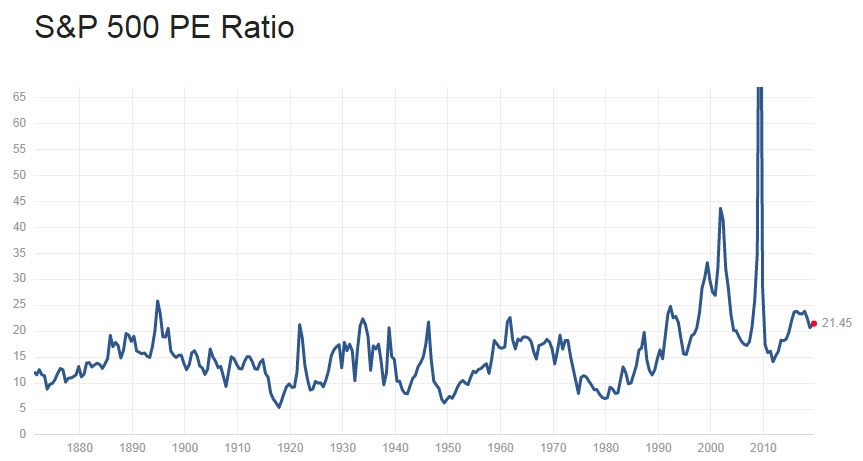

You don’t have to be an experienced value investor to understand that many stocks are currently trading at high valuations, which is not based on their financial results. I’m not just referring to Amazon (P/E of 74) or Netflix (P/E of 122), which trade in super-expensive valuation, but to low-tech companies like Johnson & Johnson, which trades at P/E of 22 and grows just a few percents a year, or Coca-Cola, which trades at P/E of 32.5 and at best will grow 5% in the next few years, and I can continue with this list as much as you like. In fact, even after last week’s declines, the S&P is still trading at an average price to earnings multiplier of 21.5, well above its average historical value, around 15.

Source: https://www.multpl.com/s-p-500-pe-ratio

Even those who like to look at the sales multiplier of the market, which is the favorite valuation measure of Warren Buffett – the total market caps of all public U.S. companies divided by the U.S. GDP, will find that the stock market is in a high territory.

It’s important to remark that some investors claim that this multiplier has lost its power because a significant portion of the companies’ sales originate outside the U.S. and are reported to other tax authorities, therefore are not taken into account in GDP (and also in GNP). Thus, the GDP does not correctly reflect the total sales of American companies. The exact amount of overseas sales is difficult to estimate, but on the other hand, the annual GDP of the U.S. is $21.34 billion a year, so even if overseas sales are a few trillions of dollars, Buffett’s sales multiplier will probably still be higher than its fair level.

Source: Gurufocus.

Why the market didn’t fell until now even as the economy slows down?

The high valuation of the stock market happens for two reasons: the first, investors’ run to the big companies and the second is the low-interest rate in the US, which has recently even started moving downward.

Each month, hundreds of billions of dollars are poured into the market, about 70% of which goes to buy bonds and 30% is invested in stocks. In recent years, the passive investment revolution has been strengthened, so the bulk of that money flows toward ETFs, much more than what flows into mutual funds. Big companies make up most of the weight of the indices (for example, the top 10 companies make up about a quarter of the S&P500 index), so most of the money flows to buy more units from those stocks, pushing them up in the good times and preventing them from falling sharply in the negative periods.

The companies also participate in the celebration and buy back their shares on an unprecedented scale. In most cases, it would have been preferable if the companies had invested the money for growth, but in an era when loans are quite cheap, the companies prefer to buy back their shares and finance growth by increasing debt. This card tower will only collapse when interest rates rise above 3% -4%, but it won’t happen in the near future.

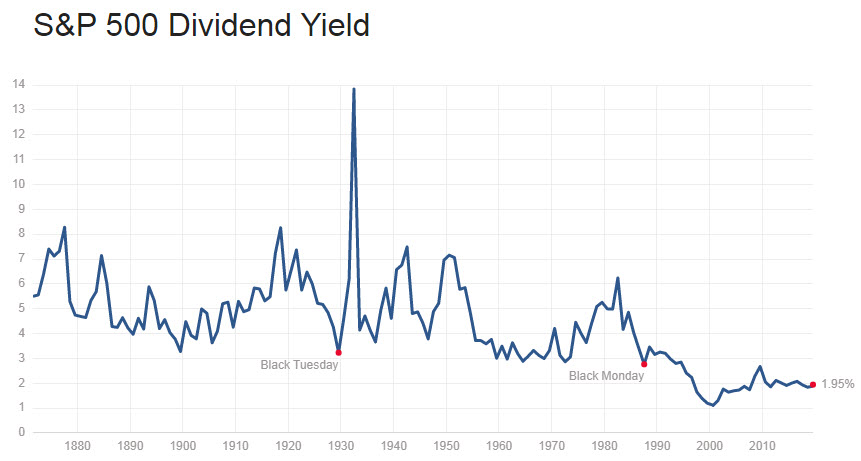

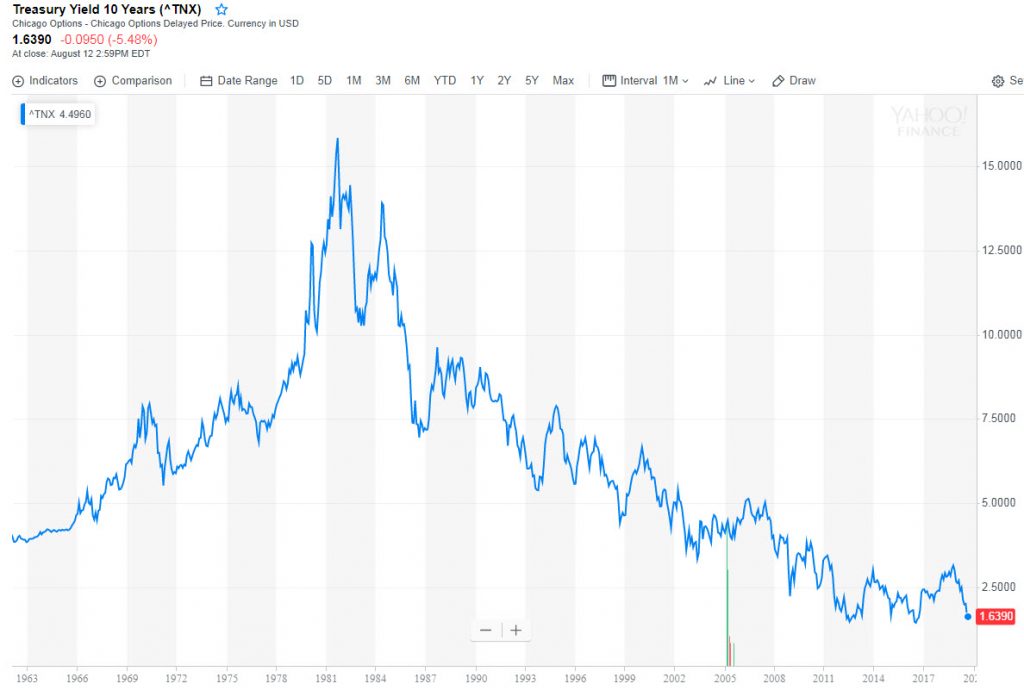

The low-interest-rate also supports the continued rise of the stock market, again, especially in large companies that distribute dividends. For example, Johnson & Johnson’s dividend yield is not impressive at all – 2.8%, and that of Coca-Cola – 2.9%. The S&P500’s dividend yield is the lowest in years, 1.95%. On the other hand, the yield on US 10-year treasuries is currently only 1.60%, the lowest in decades.

The US bond yields have fallen to such a low level mainly because of the Fed’s lowering of interest rates, but also because of investors’ great fear of economic slowdown around the world. This pushed investors towards the safe bond market, raised bond prices sharply and lowered the yields to maturities to historic lows.

As investors look at the unattractive alternatives on the market today (including bonds, real estate, etc.), they agree to buy Johnson & Johnson and Coca Cola shares with a dividend yield of just under 3% at any price, even at a P/Es greater than 30, and prefer them over shares of smaller companies that distribute fewer dividends or not at all. This is why value stocks lagging the market in recent years.

Specifically, our portfolio has three energy companies, which in my opinion is the cheapest industry on Wall Street today, but also the least popular because of the fall in energy prices over the past year, which has put pressure on the portfolio in recent months. A very interesting article on the subject you can read in this link.

Source: https://www.multpl.com/s-p-500-dividend-yield

So what’s the smartest way to invest right now?

As usual, we do not have a crystal ball for forecasting the stock market ups and downs, so the smartest way to earn high returns in the long-term is to hold a portfolio of companies from a variety of sectors that are trading below their intrinsic value (fair value). As mentioned, in recent years investors have preferred to invest in large companies over these value stocks, but according to history, this will not last forever. Even if it takes a long time for the large stocks to adjust to more reasonable pricing, which is in accordance with the moderate growth of most of them, I predict that in the foreseeable future a sizeable portion of the money will also flow to the smaller companies’ value stocks. The sophisticated investors are already picking up these shares and the companies are also making buybacks of their shares because they understand the opportunity here to bring value to their stockholders. In my opinion, this is the smartest way to go in your portfolio as well.

At this point, I prefer to wait patiently and not increase the positions in the portfolio, but I will probably do so later on if prices continue to fall. Those who still want to strengthen their portfolio a bit, in my opinion, the three energy stocks – VST, CEIX, and RVRA are excellent candidates for this (but not above 5% -7% of the portfolio’s value per share). The negative trend in the industry may continue for some time, but these stocks are already deeply undervalued. FCAU and EBIX are also trading at an attractive price in my opinion. As the automotive market begins to recover and as the synergy between EBIX and Yatra, which was recently acquired, becomes clearer, investors will have to drive those stocks to more reasonable prices. Park Hotels & Resorts (PK) also looks attractive at the current price (its forecasted dividend yield for the coming year is 7.2%).

Anyone looking for greater stability can strengthen his position in CONE (but not above 10% of the portfolio). While the stock is valued at high multipliers compared to a typical value stock (and at an all-time high, so you may have to wait for some correction to happen), but it is a very high-quality growth company that has tremendous growth potential ahead for many years.

In addition, in the past month I started going through all the major US companies, one by one, to look for opportunities that may have popped up in recent weeks. I have already found some interesting candidates (for example MU), but I have yet to complete the analysis for them, so I do not have a closed buy offers yet. Of course, I will keep you updated with every action I’ll take in the portfolio.

Patient investors will be rewarded big-time in the long-term. Always remember that.

Be the first to comment on "Does the stock market really need to cool-down?"