Inexperienced, shortsighted investors are afraid of the market collapse, sell

In more details, when there are sharp declines in the markets, inexperienced investors usually sell their portfolio and lose money. Those who buy from them and make big profits are the smart and patient investors who buy cheaply and then sell the same securities to the inexperienced investors when they return to the market, as usual, too late. This cyclicality occurs time after time in each cycle of market ups and downs.

So do yourself a favor, and this time listen to the things I am writing here so you will not panicky sell your shares and bonds and join the small group of smart investors who make profits from rational long-term investing in the stock market.

Main points

- The markets saw strong and unusually steep declines recently. This implies that the rebound will also be strong and fast. Anyone who sells now will lose money and miss the strong rally that will come later.

- It was well understood that the stock market is relatively expensive, but of course it was impossible to schedule the collapse.

- The main reason for the declines: the warming of the US-China trade war and the Fed’s insistence on further rate hikes in 2019.

- The US stock market is not as cheap as it was at the end of 2008, but the declines brought it back to a fair valuation level.

- Precisely for this situation, I have recently proposed accumulating a substantial cash balance in your portfolios, which will be used to strengthen existing positions and buy new shares at deep discount.

- My prediction: A prolonged bear market is not expected. The declines will occur over a limited period of time (months rather than 1-2 years) followed by a rapid recovery.

Are current declines different from other declines in the past?

The market is going through a very turbulent period. Wall Street leading indexes have already lost more than 20% of their value from the October peak. As usual, this time, too, the panic of investors is pushing them to sell whatever they can, even shares of the best quality companies traded at attractive prices, and this also affects shares in our portfolio.

Those who did not experience the 2008 crash or the short period in 2011, when the US market fell by almost 20% immediately after the end of the first quantitative easing program, enjoyed many consecutive years of rally in the stock market, and now they have to face sharp declines for the first time, and it’s not an easy thing. It’s even scary.

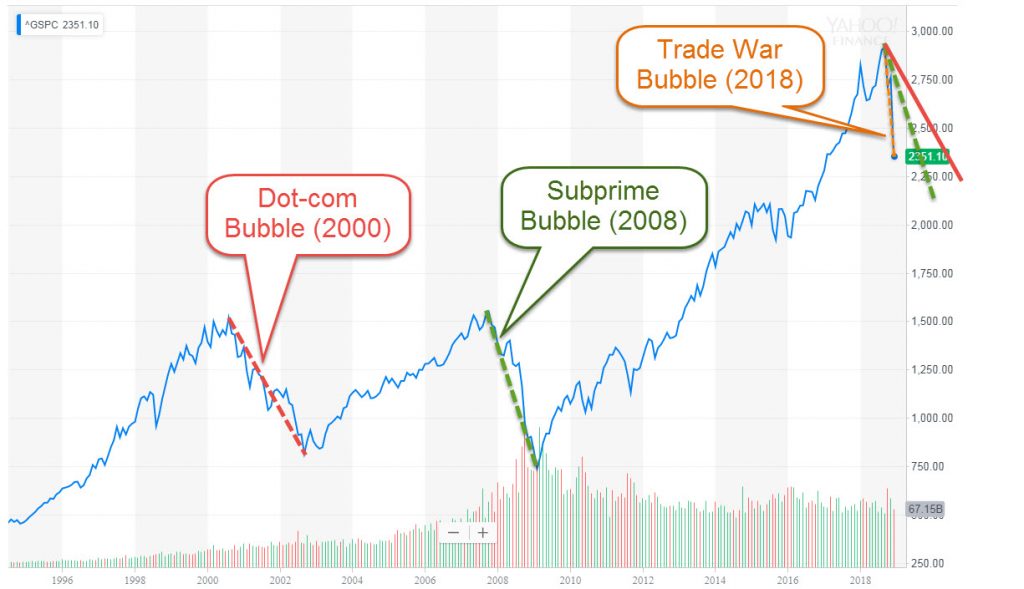

What is interesting is that the current declines are much sharper than any other decline we have ever seen in history. As evidence, the slope of the S&P chart in 2008 is steeper than that of 2001, and the slope of 2018 is even steeper. It looks like a free fall. This happens for two reasons: investors’ too quick respond (they read only headlines without deepening the company’s analysis) and the great accessibility to securities trading (because of the smartphones). This implies that the crash will be short and very steep, as will the rebound that will come later.

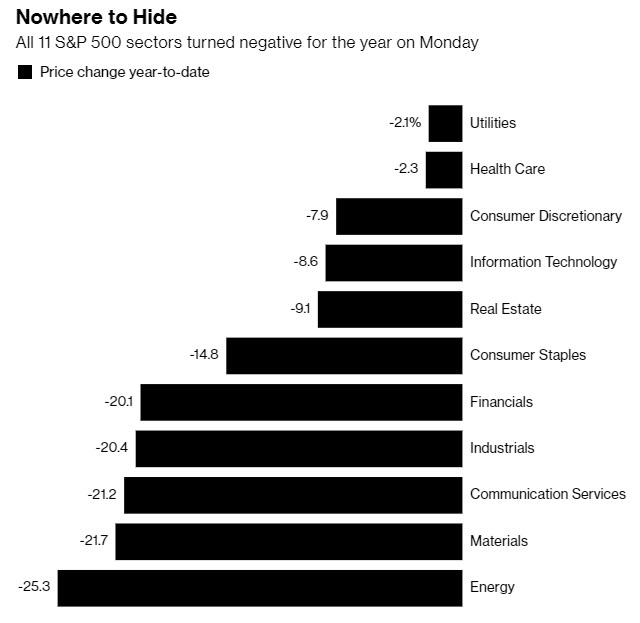

Unlike past collapses, this time there was no place to hide, as shares in all sectors went down. Energy stocks experienced the sharpest declines, despite the fact that many of them traded at attractive valuation before the declines began. Financial stocks also snatched up, even though US banks are now more stable than ever, and interest rates are expected to improve their profitability in the coming quarters.

Source: Bloomberg

The frightened investor (wrong) strategy: buying expensive, selling cheaply…

History has shown that most investors are panicking at this point due to fears of further declines and selling their entire portfolio at a significant loss. After being burned, they stay away from the stock market for a relatively long period of time and return to it only after a few years, after missing the fast and strong rally of the first boom years and buying their shares expensively, again. A few years later, another collapse comes again, and they (again) are selling at a loss and so on…

On the other hand, the smart Value Investors continue to hold the shares they purchased and as the declines continue, they strengthen positions in the shares they hold, as well as buying new shares traded at very attractive prices. As the wheel turns and the market returns to an increasing trend, they are already fully invested, and enjoy the sharp rises that occur immediately after the market’s upward trend begins.

In other words, the market is a very efficient machine for transferring money from

What are the reasons for the current collapse?

The basket of problems in the world has been known for a long time, at least five years, and along it we saw many “experts” predicting a collapse which did not happen. As in previous cycles, one arbitrary day the market suddenly began to fall, and the declines get stronger like a snowball rolling down the slope.

Looking ahead, the problems facing the world economy are very challenging, and among them are the following:

1. Surprising warming in the US-China trade war

The high tariffs plan that President Trump decided to impose on imports from all over the world, especially from China, was a good intention – to strengthen American companies, but no one believed that he would go with his agenda so far and create a fierce trade war with the Chinese.

The two sides recently agreed on a 90-day ceasefire to reach a long-term trade agreement, but Trump’s trade advisor, Peter Navarro, recently estimated that the US and China would find it difficult to reach a permanent economic agreement on the matter during this period, and that increases investors fears from a slowdown in the activity of US companies and further burdens on the Chinese economy.

2. The weakness in Europe alongside the completion of quantitative easing plan

It is known that it is impossible to wean a junkie from drags within a day. It’s a painful process that takes time. That’s exactly what happens in the markets. The countries and companies around the world have become addicted to the cheap money that the central banks have printed in huge quantities, and now we see the weaning difficulties.

In the current period, we are about to end 10 years of exceptionally generous monetary policy, during which the US Fed bought US $4 trillion in US government bonds and the European Central Bank (ECB) bought $2.5 trillion in bonds. The world has become addicted to a zero interest rate, which allows for relatively cheap financing, and now the era of free money is over and investors’ fear that it will be hard for companies to get used to is again.

The Fed has stopped its bond purchase plan over two years ago and the US has done quite well without it, but in the Eurozone there are recently signs of a slowdown, which coincide with a worsening political and social change, with the rise of nationalist parties at the expense of the veteran mainstream leaders. There are also difficulties in negotiations over Britain leaving the EU within the context of the Brexit and serious financial problems in countries such as Italy or Greece. This puts Europe’s ability to function independently without further monetary support.

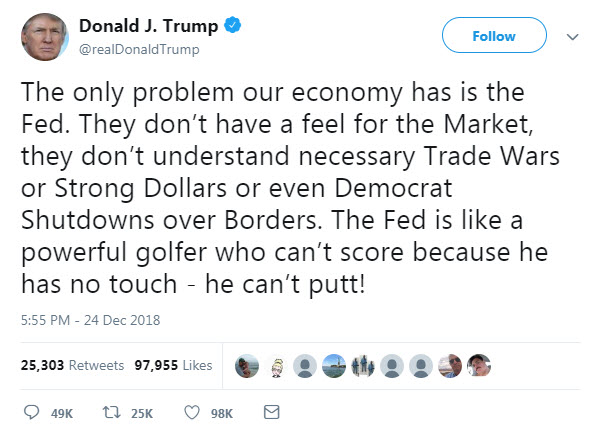

3. The Fed wants to continue raising the US interest rate while Trump opposes it aggressively

The Fed believes the US economy is strong enough and inflation is high enough to justify further rate hikes. On the other hand, President Trump and many economists are concerned that further rate hikes will halt growth and may even push the US back into recession. Trump even tweeted about possible dismissal of the Fed chairman after the latest interest rate hike. According to Trump, the Fed is the only problem of the US economy…

I also believe that at this point, when there are no inflationary pressures on the horizon, there is no logic to further interest rate hikes. However, investors fear that the Fed will go against Trump and raise the interest rate, thus loans for companies will be more expensive and this could hurt the economy and the stock market.

4. The situation in China may go out of control

China grew at double-digit rates until about two years ago, and since then it has undergone a significant phase change during which it transforms from a growth economy to an internal economy, mainly to raise the quality of living of its residents. This process is taking place during a period when the Chinese are dealing with a high debt bubble of local companies and with one of the largest real estate bubbles in history (there are entire cities that are empty of people in China because too many apartments have been built compared to the rate of migration from villages to cities).

The level of transparency of the Chinese government is so low that no one really knows what is happening there. What we see is a steady decline in China’s growth rate, which has recently been reflected in very weak data in retail sales and industrial production. The trade war with the US came at a very bad time for China, and could further slow the growth of the Chinese empire.

How low can the market go down?

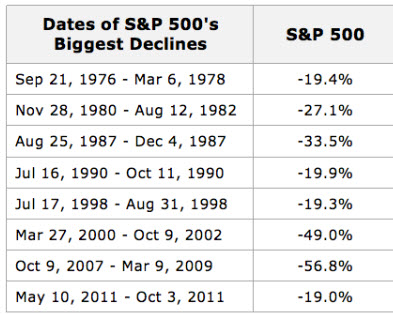

None of us has a crystal ball to predict the future, so anything I write here will be nothing more than an intelligent guess. If we look at the biggest collapses in the last 50 years, it seems that most of the declines were about 20% from the last peak, with the last two collapses (at 2000 and 2008) being abnormally stronger.

Source: goldsilver

This time it seems that the drop is steeper than any other collapses in the past, and that is indeed scary. On the other hand, in terms of valuation, the S & P 500’s Price to Earnings (P/E) ratio, which represents the US economy quite well, plummeted to 18 after the recent declines. This is a higher level than the historical average (around 16), but investors usually price the shares with earnings yield that is 2.5% higher than 10-year US treasuries, and these bonds are currently traded at 2.8%. Thus, stocks should trade at a P/E of about 18.8 (Earning Yield of 5.3%).

In other words, the US market is trading more or less at the right price for the current interest rate environment. However, keep in mind that collapses sometimes bring the market much lower than its fair value, so there may be further declines in the near future.

Source: multpl

What can end the declines and push the market up again?

Strangely enough, I think the two key factors that can calm the market and return it back to an upside trend are President Trump and Federal Reserve Chairman Jerome Powell. Both of them have to put their ego aside and act responsibly as is expected from the leaders of the world’s biggest economy. Trump should compromise and reach a fair trade agreement with the Chinese, and Powell should give up interest rate hikes in 2019.

In Powell’s case it would probably be simpler. In fact, it has already reduced the number of expected rate increases in 2019 from 4 in the previous forecast to 2 in the new forecast. Investors will be pleased if he gives up one of these interest rate hikes.

Tramp will understand sooner or later that he has no choice but to reach understandings with the Chinese, otherwise he will also cause significant damage to US companies, whose export to China is one of their main growth engines, and to American consumers, whose imports will increase. The Chinese government, too, is not interested in a trade war, so they too will be willing to compromise. Therefore, I believe that both sides will reach satisfactory understandings in the foreseeable future, which will restore investors’ optimism and raise stocks prices again.

So what to do now?

The decision regarding your investments is obviously based on your characteristics and goals, but it is important to understand that history shows that during times of decline like the current period, the best thing to do is simply nothing. Ignore the noise around and do not sell your stocks. Also, look for attractive investment opportunities that come after sharp declines.

This is not easy to implement when all the headlines in the media increase our level of fear. Well, it’s okay to be afraid. More than that, those who are not afraid of losing money may be carefree and take too big risks in their investments. But to be afraid of falling prices does not mean that you have to panic and sell the shares in your portfolio just because of that.

You have to go through the stocks in your portfolio one by one and understand which of them is likely to be hurt in the foreseeable future by the problems that the markets are declining from. If they are not expected to suffer from this, not only is there no logic to selling, but now that they are cheaper, you should even buy more from them. That’s exactly the way all the successful value investors in the world do, that’s what worked great for me in the past, and I think it will work fine this time too.

Warren Buffett said that “The best time to buy stocks is when the blood is on the streets.” This is true. However, when I look at the market, I certainly see a lot of fear, but in terms of valuation the US market as a whole may have returned to fair pricing, but it is certainly not as cheap as it was after the crash of 2008. That means that you can raise the gear in search of new investment ideas for your portfolio, but you don’t have to hurry to buy shares just because there were declines in the market. Stocks should be bought when they are traded cheap enough below their fair value. In recent days, such stocks have begun to appear like mushrooms after the rain, and if the declines continue, there will be many more of them. Despite the fear, these attractive stocks will boost your return dramatically in recent years, when the market returns to a positive trend.

I wish you all a happy and successful new year.

Be the first to comment on "How to invest smartly during a market collapse"