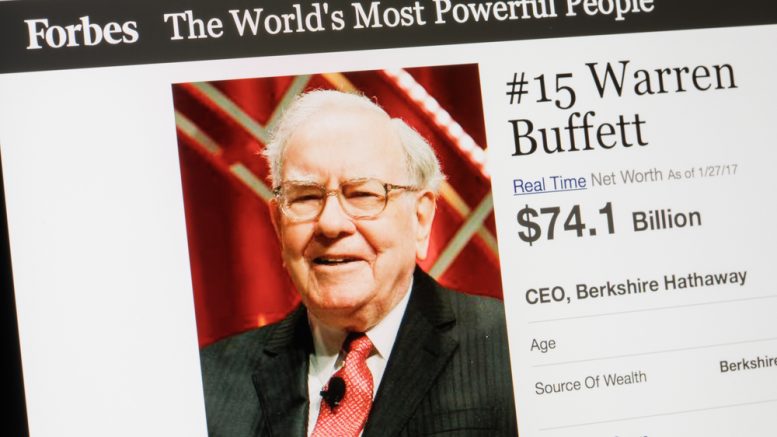

Benjamin Graham, who is considered to be the father of value investing, never pretended to help investors get rich. His main aim was to help them achieve reasonable returns on their investments. In practice, some of his students (such as Warren Buffett, Erwin Kahn, Walter Schloss, William Rowan and Charles Brandes) actually managed to get a fortune by implementing his investment principles. Warren Buffett, Graham’s most successful student, has managed to become the second richest person in the world by applying Graham’s investment methods.

Each of Graham’s students worked in a different way and chose different stocks for his portfolio over the years, but all of them based their investment principles on Graham’s basic principles – choosing shares of companies whose net worth per share are higher than the price they are currently traded at. This principle seemed obvious, but Graham’s great contribution was in writing and disseminating an organized theory based on knowledge and research accumulated over the years.

In his book “Security Analysis“, which is still considered one of the most important books ever written about the stock market, Graham revealed the main points of his theory – the fundamental value of a company is not at all dependent on the price of its shares. Contrary, it depends only on its financial data. This method of analysis was later called the Value Investing method.

In his second most important book – “The Intelligent Investor“, Graham went on to explain in detail how his principles of value investing could be applied to finding attractive stocks for investments by looking for discrepancies between the value of the company and the price at which its shares are traded on the stock market.

It is amazing that even today, more than 60 years after the exposure of the principles of value investing, most investors still view the stock market as a speculative gambling arena, act on gut instincts and examine the share price instead of examining the company’s internal value.

Warren Buffett explained this at one of the shareholders’ meetings of his investment firm Berkshire Hathaway: “You’re probably wondering why I’m telling you this [about the value-investing method]. If everyone takes the ‘value approach’, then the profit derived from this method will decrease. I tell you this: The secret has been open to everyone for 50 years, since Graham’s book “Securities Analysis” was written, and I have not seen the “value investment” phenomenon in my 35 years in the stock market. People tend to make things simple and complicated. The academic world has stopped teaching value investing over the past 30 years, and this is likely to continue in the future as well. Ships are already sailing around the world, but the Flat World Club is still blooming. In the future there will continue to be significant discrepancies between value and price in the stock market, and those that will read ‘Securities Analysis’ will continue to thrive. ”

So what are Graham’s Value Investment Rules?

Here are some of Graham’s main investment rules as expressed in his book “The Intelligent Investor” (with our own interpretation).

- Invest in the long term and do not be moved by fluctuations in the price of your shares. The capital market is like Mr. Market, who sometimes offers to buy your shares at ridiculously low prices, and thus you need to ignore him at these times. Later on, he will forget what happened in the past and will want to buy your stocks at a much higher bid that will match the real price of your shares. This is the right time to sell. So, ignore the volatility of your stock prices in the short term and do not let the market or other investors flock to influence you.

- Concentrate on analyzing specific companies rather than analyzing the market as a whole. Macro-economic analysis and its impact on the market may be interesting, but unpredictable and therefore unlikely to lead you to improve your returns. Alternatively, focus on analyzing the value of specific companies by examining their financial data and the financial ratios derived from them. Use value criteria such as Return on Investment (ROI) or Return on Equity (ROE) to understand if a company is making enough money from its operations.

- Do not try to predict the behavior of stock prices. It is impossible to execute and is not expected to lead you to improve the selection of shares for your portfolios.

- Invest time in analyzing the financial situation of the company you wish to invest in. Read the financial statements of that company and try to assess its inherent value (how much the company is worth). This allows you to assess whether it is trading at a low price compared to its actual price. Try to choose companies traded at a price significantly lower than their real price so that a margin of safety is sufficient to make the investment safe. You can do this by comparing the company’s Earning Yield (EY) to the average value in its sector – if the EY is significantly higher than the average value, the company’s shares will probably be priced cheaply.

- Stay away from stocks with high multiples or popular stocks. Popular stocks or high P/E stocks are not wise investments and are not likely to yield high returns. If you consider growth stocks, make sure you do not value growth too aggressively. Stocks of growth companies tend to be overvalued and have rallied sharply in periods where the market is on the rise and performed poorly during periods when the market is declining.

- Decide if you wish to invest passively or actively. A passive investor is a person who does not have the time, knowledge and character to find the specific shares that will lead him to achieve particularly high returns. For passive investors, investment is matched by a simple set of rules, such as building a stock portfolio consisting of a relatively large number of shares with low profit multipliers. Active investors, on the other hand, are able to invest more time in choosing a smaller number of stocks that will lead them to higher profits. The portfolio in this site is managed actively like this, and this is not a simple task that everyone can do by themselves.

Applying these rules will help you avoid making mistakes with your investments, and manage your equity portfolios wisely. This is the path that will lead you to success in the stock market.

Be the first to comment on "How to Invest Like Benjamin Graham and Warren Buffet"