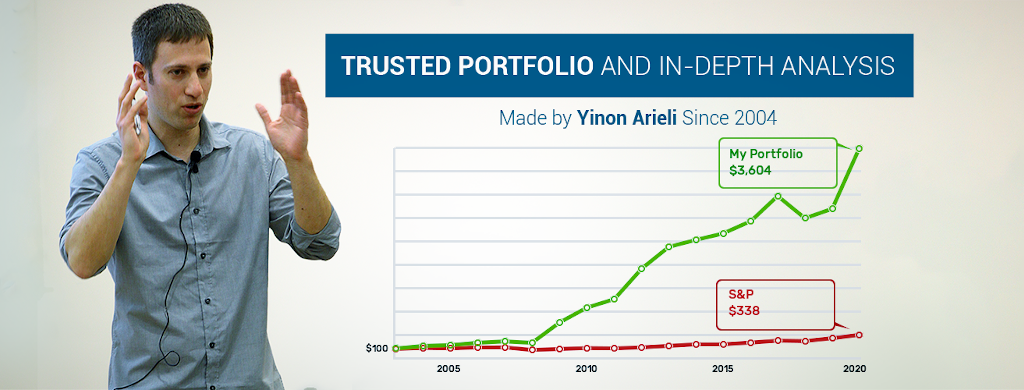

This is how $100 in the long-run-plan stocks portfolio has grown since its launch in 2004, compared to the stock market.

The LongRunPlan portfolio is a value investing stock portfolio composed of high-quality companies that were very selectively chosen and bought at a large discount below their fair value.

What is a large discount? We like buying a dollar and paying only 50 cents for it, i.e. buy a stock for less than half the price of its real worth. This large Margin of Safety increases your chances to profit from your stocks even if you missed something in your analysis or valuation process.

The portfolio yielded a +20% annual return since launched in 2004 (in Hebrew, and the English version was initiated in January 2016).

But the largest profits are made in the post-crisis years…

These are the returns of our portfolio in the four years following the 2008 subprime crisis.

The Coronavirus crisis will probably end soon, and the question is whether you will take advantage of the market declines and choose the right stocks for your portfolio?

My portfolio already has super-attractive stocks and a considerable amount of cash, through which I began to buy stocks of the best-quality companies that are traded at once-in-a-lifetime discounts. These stocks can double or even triple in the coming years as happened after the previous crisis.

I’m Yinon, a value investor for almost 20 years, and currently, I’m managing money for large investors. This is the third market collapse that I’m successfully passing so I know what works and what doesn’t. On this site, I invite you to follow my portfolio and learn in-depth how I think and which stocks I choose.

Baron Rothschild has said that “the time to buy stocks is when there’s blood in the streets”. So today, more than any other moment, I believe it’s the right time to join me on this journey.

Our investment philosophy

We apply the common value investment strategy that is based on “buy at a low price and sell for the fair value”, so after purchasing the shares, we hold on to them patiently for as long as necessary, until they are back to their fair price. Statistically, it takes a stock 1-3 years to close the valuation distortion, and indeed an average stock is held for about 2 years. However, there are cases where stocks continue to be attractive and held for a longer period of time.

These are the principles that have worked great for Warren Buffett and other gurus for decades, so we implement them in our portfolio as well:

- Manage a portfolio of about 15 shares.

- Choose quality companies without high debt.

- Focus on deeply undervalued stocks.

- Invest in growth companies from sectors with increasing demand.

- Keep an eye on spinoff stocks (why?).

- Hold stocks patiently, even for a few years.

- Don’t buy and sell too often.

- Ignore economic events and negative news.

- Take advantage of market volatility (buy when everyone is selling and sell when everyone is buying).

Following our portfolio

Following and copying our portfolio is very simple.

We send you an alert by email or text message if you prefer for every stock that is bought or sold, combined with a detailed review of the company and its stock valuation, so you can decide whether to buy it to your own portfolio.

If you’re a passive investor that doesn’t want to work hard analyzing companies and stocks, just buy and sell when we do it. If you’re an active value investor then use our stocks as initial ideas and do your additional research as you prefer.

Whatever way you choose to go, if you are a patient investor who wants to build an intelligent portfolio that has the potential to constantly beat the market in the long run, we believe that this portfolio will be very useful for you.

The site has over 400 members who are following my portfolio, so it is likely to be useful to you as well.