Jerash Holding (JRSH) is a Jordanian overlooked micro-cap clothing manufacturer (market cap of $68 million based on the share price of $6), which trades on the NASDAQ, grows consistently, loaded with cash, and probably worth at least double its current price.

Keep in mind that JRSH has a very thin daily volume of $50-100K, which is below my threshold to enter a stock to the LongRunPlan portfolio, but it could be a great stock for a smaller investor portfolio. Still, if you decide to buy do it smartly and gradually.

Background

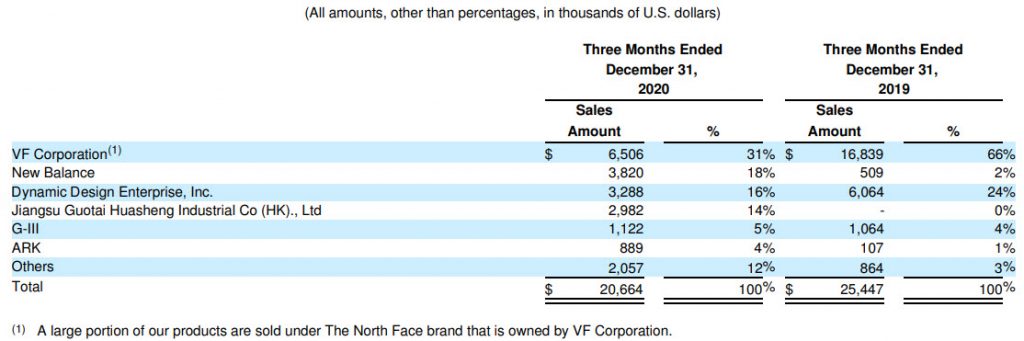

Jerash is Jordanian sportswear and casual clothing manufacturer, producing over 12 million items a year for leading brands such as VF Corporation (The North Face brand), New Balance, American Eagles, and more, through 5 factories in Jordan, Middle East. The company has 4,100 employees, about 25% of the local and the rest come from countries like Bangladesh, Sri Lanka, India, and Naples.

All images are from the company’s presentation published in November 2020.

Jerash is a company that is very easy to love – it operates in the low-tech field, it is growing, profitable, financially stable ($29 million in cash with zero debt) and it even distributes a nice dividend. The company has consistently grown at an average rate of 15.5% over the past four years, from a revenue level of $53 million in 2016 to $93 million in 2020 (JRSH’s reporting year ends on March 31).

As with many other companies, Corona has halted the growth and hit its gross profit margin a bit, but in the last two quarters Jerash has returned to a similar level of activity compared to 2020 and in the reporting year ending March 31, 2021, it is expected to report revenue of about $85 million (compared to $93 in 2020), and in the year beginning in April 2021 it is expected to return to the growing trend of recent years.

Does Jerash have a moat?

One of the first questions I asked myself when I started researching the company, is what is its competitive advantage? Does it have a moat? After all, there are a lot of Chinese and Indian clothing manufacturers that can probably produce on a larger scale and at fairly cheap prices. It turns out that the company has two strong moats, which is why I estimate that its customers will continue using its services and more companies will join them in the future.

First, in today’s competitive environment, a significant portion of the leading brands in the US prefer to manufacture their items at companies from countries where the US has a free trade agreement. This greatly reduces the range of options, because there are not many duty-free countries – Jordan, Egypt, some countries from Central America, and Africa. The problem is that most clothing manufacturers in these countries are unable to produce relatively complex clothing products such as jackets (which make up 50% of Jerash’s production). Even within Jordan itself, out of about 60 factories, only 5 factories can produce high-quality jackets, and Jerash is the operator of a few of them.

Quality is an important parameter for leading brands like VF and New Balance, and this gives Jerash another advantage, where the sewing quality is considered higher than that of competing clothing manufacturers in Jordan and certainly compared to Chinese or Indian manufacturers.

In other words, Jerash allows brands both quality and free export – a winning combination that makes the company’s customers continue to use its service for years to come.

Valuation

Jerash is a tiny company from a foreign and unpopular country, with a Chinese owner who owns 40% of the company’s shares (although he actually studied and spend many years in Switzerland), with a minimal volume, without analyst coverage, so it is not surprising that the stock trades deeply below its fair value, and certainly lower than similar companies in the industry.

Just take a look at Jerash’s balance sheet to understand the irrationality here – the company has $64 million in current assets, including $29 million in cash, zero debt, and $57 million in Total Equity, with the stock trading at just $68 million. In other words, its cash, accounts receivables, inventory, and its factories value less all its liabilities, worth $5 per share, which is even before we consider that it is a company that continued to earn during the corona period and will continue to grow in the coming years.

In fact, beyond the next quarter in which it is expected to generate revenues of about $20 million with higher profitability (because of a more convenient product mix), all of its production capacity is already ordered for another six months, until September 2021, by its large customers. The company estimates that it will reach its peak of revenues in these quarters, about $33.5 million in each quarter, and it will cross the $100 million threshold for the entire year. Management estimates that growth at a rate similar to recent years will continue in the coming years in light of the demand it sees from the leading brands it serves, mainly VF and New Balance (which increased their orders by 50% for the coming year compared to last year). The owner also does not rule out the possibility of inorganic growth by acquisitions of similar or new activities, and the company has considerable cash that can allow this.

The company has also received FDA approval for the sale of personal protective equipment (mainly facial masks), something I do not expect to give a dramatic boost to sales but it could still give some extra revenue at least in the coming year.

In addition, the company has announced that it is expected to resume construction of its new plant in Jordan soon, something that will take about a year and a half to complete, but will then add 50%-75% (!) to Jerash’s production capacity.

The company also intends to improve profitability by increasing the proportion of local workers in its factories, something that will require training of some at a certain cost, but this will contribute to the bottom line in the coming years.

Despite all these positive things, JRSH is trading at a forward EV/EBIT multiplier of 5 for the expected profits of 2021. That’s about half the valuation of its competitors, most of which are not growing at a double-digit rate as it is expected to grow.

If I perform a full Discount Cash flow (DCF) valuation assuming an average growth of about 15% in the next three years then a gradual decrease to 0% in the future, with an operating margin of 8.5% and an increase in CapEx in the next two years for the new plant, and using a conservative discount factor of 10.5%, I get a fair price of about $12 per share. If I set more optimistic parameters, taking into account the recovery in global clothing consumption, the significant increase in the company’s production capacity in a year and a half after the completion of the new plant, along with a slightly lower discount factor, I can also justify a fair price of $14-15 per share.

In short, JRSH has a downside of about $5 (its Equity per share) in the worst-case scenario where growth will stop and problems will arise in the business, compared to an upside of +100% even in a relatively conservative case. This looks like an attractive investment and if its volume was larger I would buy it to the LonRunPlan portfolio.

By the way, the owners and management warrants which expire in 2022 and 2023, have an exercise price of $6 to $7, which also places a certain floor on the share price and gives managers great motivation to lead the company to successful results in the coming years.

What are the risks?

The main risk is the company’s dependence on VF Corporation, which previously accounted for about 75% of sales. In the past year, the company has scattered sales across a larger number of customers and reduced that dependency, but as it currently stands, VF’s share of sales in the coming year is expected to grow again. But, as I explained earlier, there is a good reason why VF chose to let Jerash produce its clothing items – because of the high quality and duty-free issue that Jordanian companies have, so this risk is limited in my opinion but still exists.

Also, keep in mind that Jerash operates most of the time at full capacity, so it is unable to receive orders from significant new customers. In fact, this year it will be so full that it will even move some of its production volumes to other companies’ factories to meet demand from it. Therefore, I assume that even if VF decides to produce elsewhere, Jerash’s machines will work for other leading customers.

Another risk is of course the fact that this is a small company with relatively low daily volume, something that can cause higher volatility in negative times in the stock market. But, as I said, I think the stock has a certain “floor” around its equity per share, about $5, so the downside seems relatively limited.

Bottom line: JRSH is a small but quality company with significant growth potential in the coming years, with a very strong balance sheet, which with a bit of a windfall from investors will climb to a more reasonable price, at least $10.5, and most likely also above $12 per share in the next few years.

Be the first to comment on "Jordanian clothing manufacturer at a discount: Jerash Holdings (JRSH)"