Many predict that the global economy is headed into a recession but stock prices are flying up. how is it possible?

Well, the global economy is indeed looking depressed due to the Corona lockdown, Except the giant companies which did pretty well recently, most companies are posting weak results for the second quarter of the year. This is not surprising – the whole world has been completely shut down in recent months. On the other hand, the US stock market and other markets around the world have corrected March declines. It seems odd, but there are two main reasons which explain it: the temporary of the corona and the deep pockets of the US Federal Reserve.

Many healthcare companies are working hard today to develop a cure or vaccine for the Coronavirus. Billions of dollars are being invested in it as everyone knows that whoever wins the race will make tons of money. The world’s drug authorities have also stated that they will rapid the examination and approval processes, making it easier for companies to advance through the clinical trial stages, which on routine days take years for regular drugs.

In light of this, most investors believe that a vaccine for corona will be found over the next 12 months, so there is a good chance that by mid-2021 most of us will already be vaccinated against the virus and life will return to normal. This means a very rapid economic recovery in the form of V-Shape and this is reflected in the rapid recovery of stock prices.

In addition, concerns regarding a severe economic crisis led the Fed to print $2.5 trillion in March and April and sharply lower US interest rates to the lowest level of 0%-0.25%. This means that even companies that are in liquidity difficulties or those whose activities are “bleeding” will be able to receive financial assistance and loans at attractive interest rates from the US Federal Government so they can continue to operate over time.

If you ask any novice economist, he will tell you that printing trillions of dollars is an unwise way that will lead to an increase in the US deficit and hyper-inflation, and therefore it will not last long. But in practice, we see huge quantitative easing plans around the world but the inflation is not rising. Should the economics books be updated accordingly? Maybe, but we will only know the answer in 10 years from now.

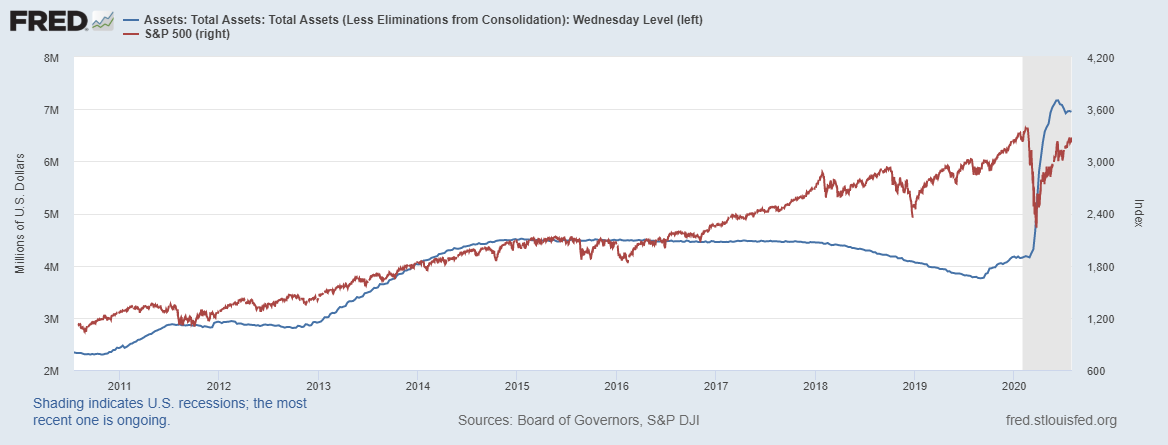

Meanwhile, the dollars the Fed “throws” at companies are helping them get through the crisis, and investors love it and are running toward stocks. The proof of this can be seen in the chart above, which shows the S&P500 index in comparison to the Fed’s balance sheet. It’s easy to see that as soon as the Fed announced a return to its money-printing program and bond purchases in late March, stock markets began to soar sharply.

It’s interesting to see that dividing the value of the S&P500 by the Fed’s total assets, shows that despite the sharp rise in the index in recent months, the Fed’s dollars printing was so fast and large that the ratio dropped to as low as it was in 2016. Combined with the fact that US interest rates are expected to remain at zero levels for another long period, I think this implies that we are going to continue an upward trend for stocks in the foreseeable future.

But not all stocks recovered…

The reasons I described earlier did push the NASDAQ index to an all-time high and the S&P500 to trade just a few percent below the pre-Corona price level. But this picture is misleading as only a handful of individual stocks went up dramatically while many other stocks are still trading deep below their February peak.

In fact, when you look at the numbers in-depth, you notice an amazing fact: The 5 giants – Apple, Microsoft, Amazon, Google, and Facebook, are responsible for most of the returns of the leading indices in recent years. These trillion dollar companies have increased their share in the index from 10% in early 2017 to over 20% recently. It’s amazing that only five companies represent almost a fifth of the US economy!

The strong rise of their stock prices and their high market share in the indices is what pushed the indices to correct the decline following the corona. Without them, the US indices would have traded today at a price level similar to that of the end of 2017, so that those who achieved a positive return in 2019 and 2020 can be satisfied that they managed to overcome the actual stock market.

So, should you chase the stocks of the big tech companies?

In recent years the capital market has been a very rewarding place for irrational investors, I would even say “lazy”, who do not analyze companies but simply run after companies that show growth, regardless of whether this growth is also reflected in positive net profit.

A few days ago a friend asked me why people buy shares of Tesla Motors for example, for whom the dream is big but in practice, it continues to lose money?

Although the company will likely move to positive profitability this year, its market cap already reflects as if it will take over 60% of the car market worldwide. It’s not a reasonable outcome, but most investors don’t care.

Hundreds of thousands of investors are excited about the dream, buying the stock and push it further and further up even though its valuation is in a bubbly zone.

Tesla obviously has other activities as well, but they are unlikely to yield high profits in the foreseeable future, so that too does not change my conclusion about it expensive valuation.

Tesla is not alone. Look at WIX, look at the meat-substitute company Beyond Meat, look at Zoom, look at the drug companies that have declared drug development for Corona and their shares have flown up even though they do not even have sales yet (the owners of Moderna, for example, have already sold all their shares so they too agree with me that its valuation is too excessive).

Look also at the shares of Kodak, which in recent days has soared by thousands of percent because the US administration gave it a $750 million loan to rescue it from its bankruptcy and help it divert its operations towards the production of critical pharmaceutical components. In practice, it will take years for the company to reach meaningful sales and profitability, but again, investors don’t care…

This story will not last forever. As always, sooner or later logic will return to the market and investors will price companies according to their actual business results, and the shares of the bubbly ones will correct down to more reasonable pricing. This is also true for some of the giant companies I mentioned earlier.

What is the appropriate investment portfolio composition for the current period?

However, ignoring the big 5 giants is not smart. These companies shape and influence our lives every day, we constantly use the products of most of them, and they have power and control over the business, governmental, media and social activities of almost every country in the world. Thus, they will continue to grow and it’s wise to keep tracking their stocks.

Among them, Facebook is traded below its fair value, and I’m glad to hold it in my portfolio.

I predict that when the noises around these giants end and the advertisement boycott around social network finalized, the stock will jump strongly.

Actually, Facebook even showed quite impressive growth in Q2 2020, when everyone thought there will be a savior reduction in marketing budgets, and this is very encouraging for the near future.

In addition, I continue to base the portfolio on particularly undervalued value stocks, which exhibit financial stability even during the corona lockdown period. I’ll update regarding their operations after they publish their Q2 2020 results.

Also, I think that in such a volatile and uncertain period it is important to keep a substantial cash balance of at least 20% in the portfolio, in order to be liquid enough to buy opportunities that will arise down the road. In my opinion, this is a smart asset allocation that will allow the portfolio to beat the indices over time.

Be the first to comment on "Did The Market Actually Recover From COVID19?"