At the end of December 2016, Diversified Restaurant Holdings (SAUC) completed the separation of Bagger’s Dave’s Burger Tavern (BDVB) through a spin-off. Bagger Dave is a small fast-food chain with 15 branches in Michigan, Indiana, and Ohio, which mainly offers meat meals at discounted prices.

SAUC probably expected the move to help it return to positive profitability, which has not happened so far. Bagger Dave’s financial condition is also not brilliant. Even the $2 million SAUC gave them before the separation did not help. Sales in the third quarter of 2017 contracted by 23% and net loss increased to $2.6 million ($2 million in the previous quarter). Cash on hand fell to $0.9 million, fixed assets dropped 29% year-on-year to $10.2 million, and equity shrank by 36% to $9.7 million.

In light of the negative results, it is not surprising that the stock went down sharply, but does this justify a 90% drop in its value since the spin-off? Should the stock trade 85% below its Equity? This discount, on paper, has led a number of investors (such as this) to cover the company as a hidden gem with tremendous upside. Is that so?

I don’t think so.

Why? First of all, sales are declining and the company continues to lose money every quarter. The restaurant business in general and fast food industry, in particular, are saturated with restaurants, and competition is only expected to increase in the future. In addition, considerable Capital Expenditures costs are required to keep the restaurants at a level of maintenance that will attract customers. The problem is that in the financial situation of Bagger Dave, it will be almost impossible for them to raise new money. Therefore, the company will probably continue to burn the cash it has left until finally it will not be able to pay the suppliers and the chain’s branches will close one after the other.

If you think there is a chance of seeing a buy offer for Bagger Dave at a value higher than the current market value, this is also in a very low probability. Remember, this is a tiny, not very popular company trade at a market cap of about $1.4 million, so anyone who wants to sell burgers will probably prefer to buy a more stable chain or build their own brand.

And what about the fact that the company is traded deep below its asset value?

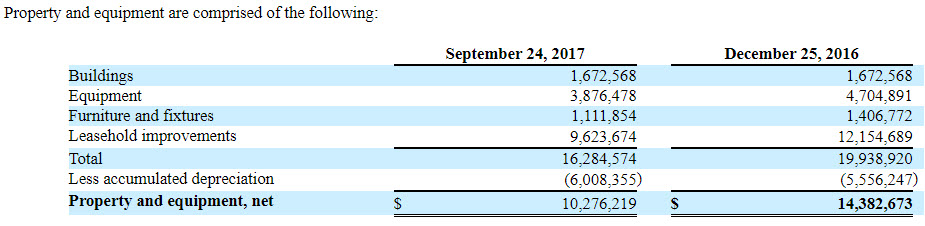

Well, BDVB is not a Net-Net stock that Benjamin Graham would buy, as the company’s Equity is mostly built on its fixed assets. These assets consist of $1.6 million (without deducting depreciation) of lease agreements on the buildings in which the chain’s restaurants are located, and another $8.6 million of equipment, furniture, and structural improvements. These lease agreements are worthless if the Company’s operations cease. The equipment is not worth much either. It is known that in the sale of a restaurant, the equipment and furniture are sold at 10% -20% of their balance sheet value (incidentally, a few years ago I bought 3 tables and 6 chairs from a cafe before closing, at a quarter the price of a single table …) .

Therefore, if we combine the $1.5 million of current assets together with, let’s say – 15% of the fixed assets, and ignore the intangible assets, we will receive total assets of $3.1 million. Deduct $1.4 million of liabilities and you get a fair Equity of $1.7 million. This is not much higher than the current market value ($1.4 million, at a share price of 5 cents). In a few quarters, all the cash will be burned, so that in fact the equity will shrink further in the future, below the current market cap. Thus, even from the Equity consideration, there is no real opportunity here.

In conclusion, in my opinion, Bagger Dave’s Burger Tavern is going to be closed in the next year or two and the stock will lose most of its value. It’s not easy to go down in price when you trade at 5 cents per share, but yesterday the company announced its intention to make a 400: 1 reverse split, which would transfer the share to trade at $20, and from there it will be much easier to go down. Stay away from BDVB.

2 Comments on "Bagger Dave’s Burger Tavern – Asset Play or Value Trap?"